The cruise line industry has been destroyed over the past several months to due worldwide restrictions in traveling from the Coronavirus. NCLH or rather the Norwegian Cruise Line has been caught up in this downturn as well.

One day the Coronavirus shut down of the global economy and travel shall pass but until then it has raised my eyes as to what stocks could benefit the most when the world returns to the way it was pre-Corona.

The time frame I am using to examine the NCLH stock is going to be the weekly time frame. I will also look at the daily for a bit but the main setups will be off the weekly.

So the first part of this article will be my technical analysis for NCLH.

Then I will have a quick video covering the setups because sometimes it is easier and faster to see what I am talking about rather than reading it in this post.

After that, I will provide information regarding the fundamental side of the stock. I don’t dabble too much on the fundamentals but they can help with the timing to see if it is the right time to start buying or selling the stock.

NCLH Stock Forecast

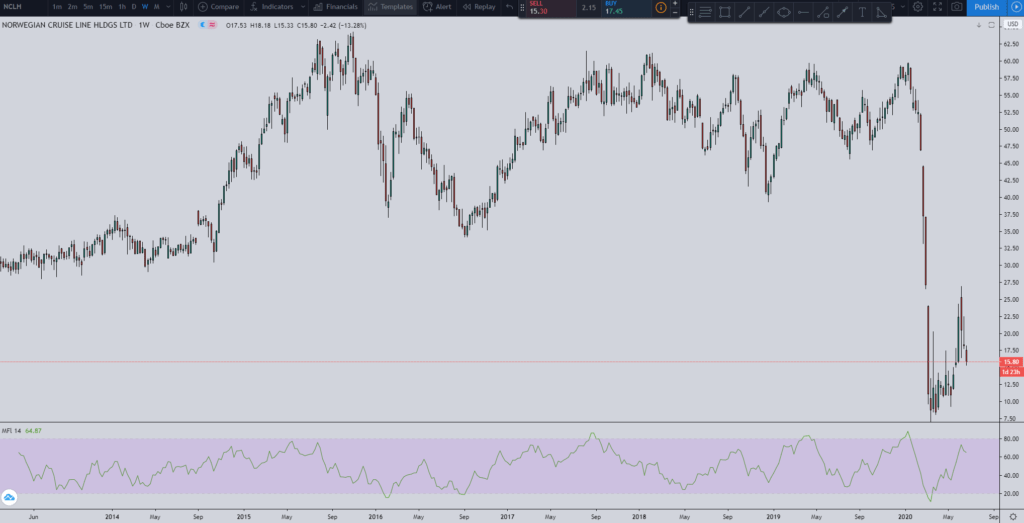

The image below is the overall life of Norwegian Cruise Lines. As you can see the recent weeks have been terrible for the stock.

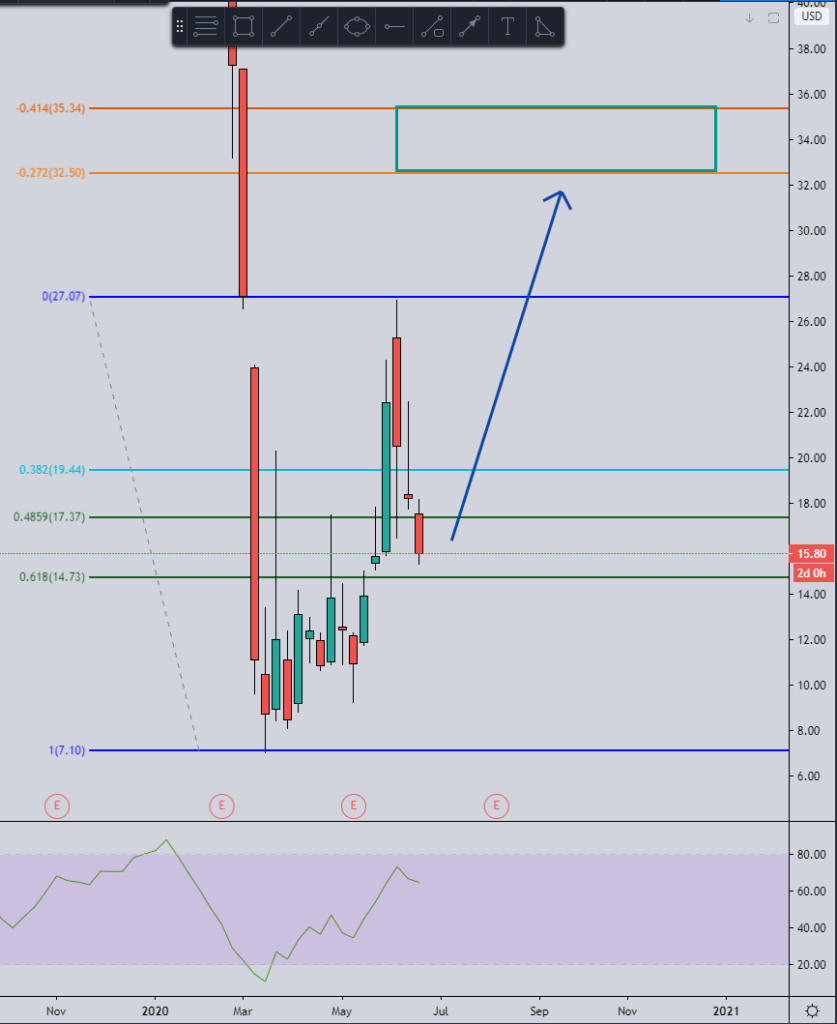

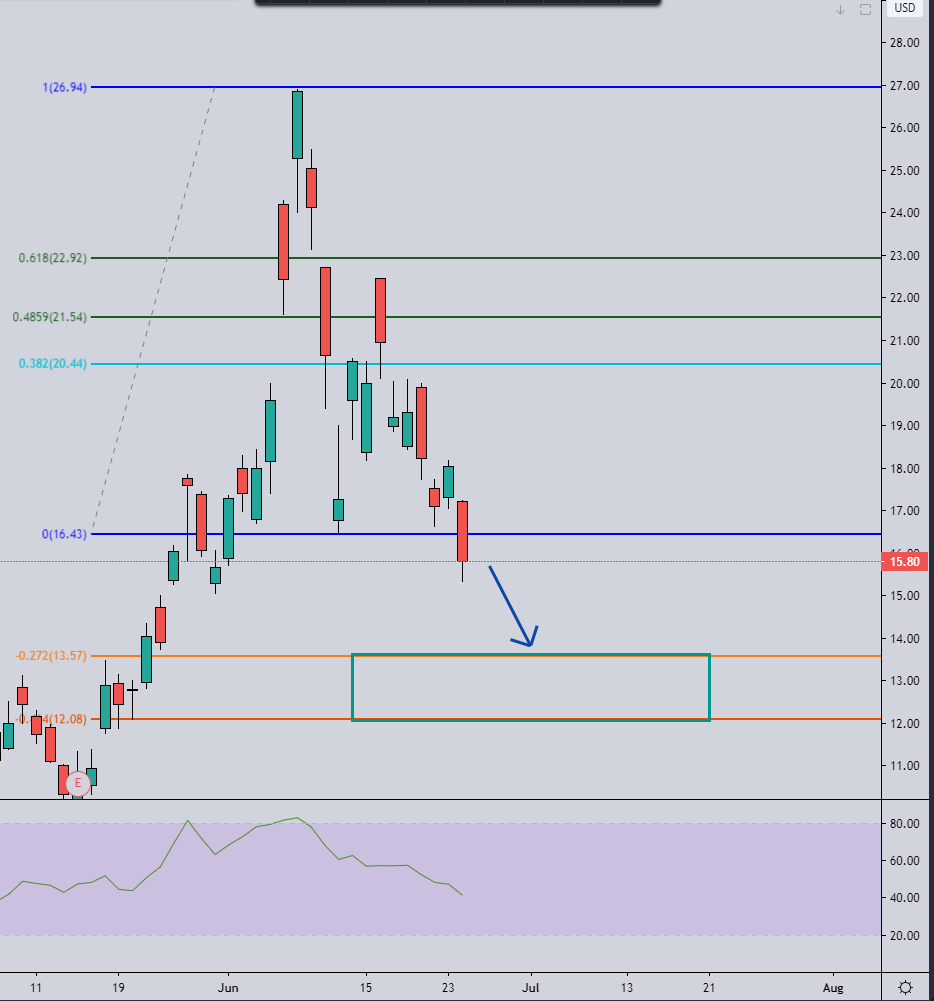

In the picture below I am using the weekly time frame. This setup for NCLH is currently a long setup that has been activated.

The current price target for this move is $32.50. With the stock sitting at $15.80 there is good risk/reward here.

But if the stock goes to around $10.00 then I would consider nixing this trade because the shorts will have the momentum.

But at the same time, this could be one of those trades that you get in willing to lose everything if the stock goes bankrupt. There is a chance for this stock to make some amazing returns so even if the stock continues to move lower you could make the argument for adding onto your position.

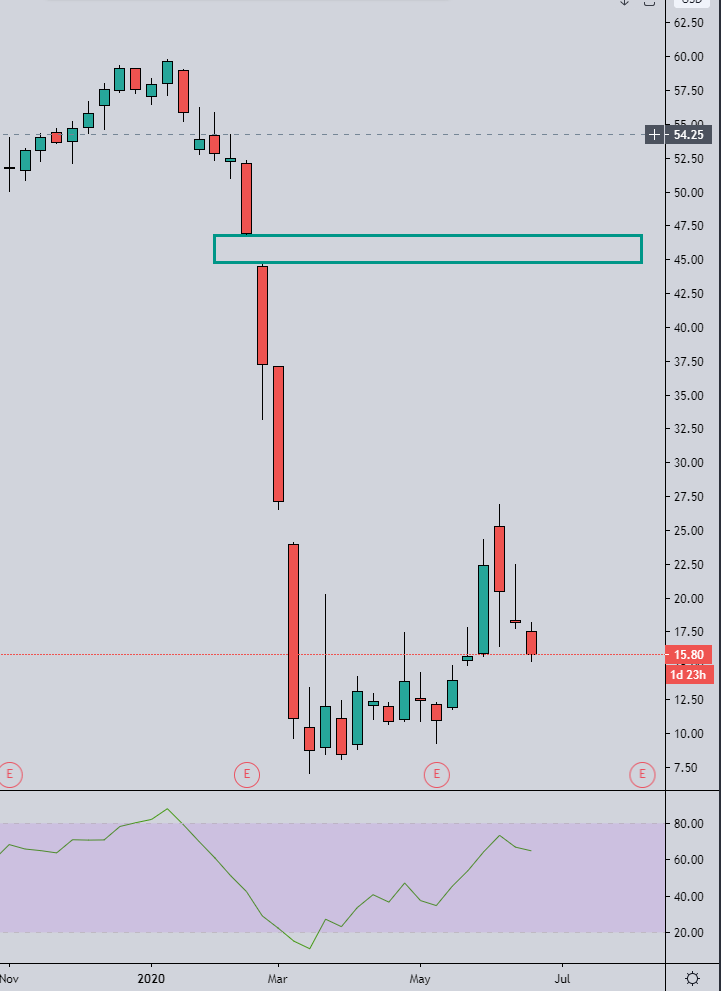

There is a short set up in the daily chart that I will talk about later in this post so keep that in mind as well because it ties into this long setup.

You can also see how a gap was recently filled and once the price filled the gap it has gone down ever since.

To add to the long setup above, there is also a gap on the weekly chart to the upside that has not been filled.

Gaps do not always get filled but when I see one for a stock that could be a good buy then a lot of the time it eventually acts as a magnet to pull the price up to it.

I highlighted the gap with a green box. It goes from around $45 to $47. You can see how the previous gap below it was filled and was used as resistance once filled.

There is a short set up in the daily chart where the image is below. The target I am looking for is $13.57. With price currently at $15.80, I would not short the stock but would be waiting for the price target to be hit at around $13.57.

This aligns with the long setup I showed above. If the price does go down and hit $13.57 then it would be a little low for when I look to go long. That means the price would be lower than the 61.8% Fibonacci retracement level for the long setup (I’ll explain this in the video covering these setups).

So if I was to go long I would wait for this short setup to complete first.

Norwegian Cruise Line Stock Prediction

NCLH Stock News – Not Much Good to Report

To see what the Norwegian Cruise Line is all about then here is the link to their investor’s relations page.

http://www.nclhltdinvestor.com/investor-relations

When I go over a stock I also like to provide information on the fundamental side of the stock. I wish there was better news to report for NCLH but unfortunately right now most of the info out there is on the negative side.

Recently they just had a senior partner resign:

https://www.seatrade-cruise.com/news/apollos-steve-martinez-resigns-nclh-director

Steve Martinez resigned from the board of Norwegian Cruise Line Holdings, effective immediately. Martinez is senior partner, head of Asia Pacific, for Apollo Global Management. He was the Apollo partner who led the investment first in Oceania Cruises and then, in 2007, in Norwegian Cruise Line. Apollo eventually cashed out of NCLH in November 2018.

In a filing, NCLH said the resignation did not involve a disagreement with the company on any matter relating to its operations, policies or practices.

When people resign it is hard to tell if that is a good or bad thing. Mr. Martinez had been there for around 13 years so unless he was making decisions that were costing the company big losses then it raises an eyebrow when a senior member suddenly resigns.

The market had been hinting for a while that there will be a reduction in cruise ships.

Royal Caribbean just had 3 of their ships declare bankruptcy and many believe the other companies in this sector will lose ships to bankruptcy. This is shocking but at the same time to be expected because you can’t keep the same number of ships in your fleet when they are all not being used:

https://www.fool.com/investing/2020/06/22/royal-caribbeans-spanish-joint-venture-declares-ba.aspx

A Spanish unit of Royal Caribbean Cruises (NYSE:RCL) has filed for bankruptcy because “the headwinds caused by the pandemic are too strong.”

The Pullmantur Cruceros joint venture with Cruises Investment Holding filed for bankruptcy protection under Spanish insolvency laws with an eye toward reorganizing. Royal Caribbean owns 49% of the company while Cruises Investment owns the 51% majority.

The biggest recent news is the Norwegian Cruise Lines postponed the re-opening of their cruises until October and other analysts agree that their competitors will do the same. Many were hoping the cruise lines will start back up in the summer but now it looks like fall will be the earliest that cruise lines are back open for business. This assumes the world still isn’t shut down from the Coronavirus:

https://www.fool.com/investing/2020/06/17/cruise-line-stocks-wake-me-up-when-september-ends.aspx

If you were hoping to set sail on a summertime cruise this year, it’s probably not going to happen. Norwegian Cruise Line Holdings announced on Tuesday afternoon that it’s canceling cruises embarking between Aug. 1 and Sept. 30 across all three of its brands. Only Seattle-based Alaskan voyages will stick to their September sailings. Select cruises including Canada and New England sailings are being suspended even longer, canceled through October as a result of travel and port restrictions.

Norwegian Cruise Line Stock Conclusion

For me personally, I am not looking to enter the stock until the daily short setup completes. From there I would then see about getting long.

This doesn’t mean I would for sure buy the stock but that is the level I would be looking at buying. Around $13.50 would be where it would pique my interest.

If you believe in NCLH for a long-term trade then there is some serious upside potential. This is one of those stocks that has been battered and bruised from powers outside of its control.

When the world finally says goodbye to the Coronavirus shutdown then this is a stock that could create some big gains.