This post will be one that features the Nasdaq Futures Live Trades for July 2019 with precise entries and exits. Just like with my S&P Futures Live Trades for July 2019 With Precise Entries and Exits post, this will be a running post throughout July. It will feature the trades I am looking at taking, am currently in, or have just completed.

I will try to post the trades with enough time ahead of them if you are looking for trade ideas but I can’t promise they will always be on time. I will do my best but some will be after the fact and there is nothing I can do about that. Also, I will try to provide a video for each so you can have a better description of what I look for when I trade.

The Broker and Trading Platform Used

The broker I am using is AMP Futures. This is the first time I have used them to trade live but so far so good. The platform I am using is TradingView. When I first started using their platform I never envisioned I would be using it to trade live one day but here I am. Ninja Trader, in my opinion, is still superior for day trading but TradingView does the job.

The biggest advantage TradingView has over Ninja Trader is I can trade from any computer or tablet since it is HTML based. That right there is huge. I never realized how big of a deal it is but it really is a huge deal. This frees up when and where I can trade and I do not now have to have a dedicated computer or laptop for trading. That was always a big hindrance since right now my full-time job is not day trading. The goal is eventually to have it be one of my primary sources of income but right now it is not.

The main issue is I haven’t found is how to cancel resting entry orders if the live trade I am in is completed. I’m not sure if it is offered in TradingView. When a trade completes and my exit is hit then with Ninja Trader the other resting entry limit orders would automatically be taken off. So far I haven’t found a way for TradingView to do that. Maybe they do and I just need to look harder.

But overall I am satisfied with TradingView. A bonus of using AMP is they waive the cost of using the TradingView platform. The stupid ad is still there but there isn’t a monthly cost to use it. I may upgrade to the Pro plan someday just to support TradingView because now I don’t have to have a dedicated laptop for a single trading platform like I did with Ninja Trader.

I am trading the e-mini micro futures for the Nasdaq. They were just created a month or two ago and require 10X less leverage than the minis do. This was an awesome change that helped the smaller traders like me (small as of today) get involved with futures trading. In my opinion, this was a very good idea to help the futures market become even more robust. As far as I know, the micro contracts operate the same as the minis so if you do change the minis then these charts should still be the same.

Nasdaq Futures Live Trades

Here are a couple of items to recognize the way I trade:

- I don’t use stop losses

- Trend lines are rarely used

- In most trades I scale into the trade

- I don’t always wait for the profit target to be hit

- If I feel I have enough of a profit locked in then I will take it

- I am still learning and make mistakes so I am not perfect

- I use Fibonacci retracements and extensions for all of my trades, they are the basis for my entries and exits

I still struggle with fear and greed. So even though I may have the profit target listed I don’t always wait for it to be completed. Fear and greed are the two biggest factors in trading and they still come up in most trades. Sometimes they have no impact on my trading and other times I feel their pull greatly. The biggest times I feel their pull is when I have a decent sized profit and I would rather lock it and get out early rather than see the gains evaporate. I can always get back in again if the setup is still valid.

I attribute all of my success to meditation. There are ways to improve your meditation once you get started but the most important thing is to just do it. Consistency wins. You will experience amazing benefits in all areas of your life if you can take 30 minutes out of your day to close your eyes and wait for your thoughts to quiet.

So without further ado here are the trade setups for the Nasdaq Futures Live Trades for July 2019 With Precise Entries and Exits:

Monday, July 22nd

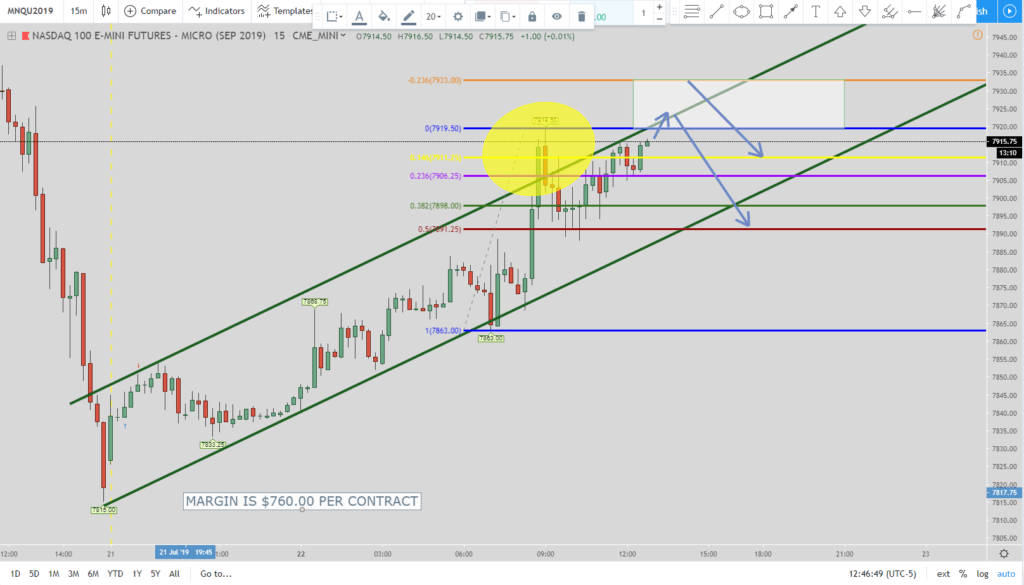

This isn’t a live trade but is something I am watching. Do you see how price broke out of the trend line channel to the upside? I highlighted it with the yellow circle. When price breaks a trend channel it usually comes back and breaks it the other way.

So what I am looking for is hopefully the price will break the previous swing high of 7,919.50. Then I will either look for the Springboard short setup (if the price doesn’t hit the orange line) or a 123-161 short setup (if the price does hit the orange line). Either way I have a short setup in my sights if the swing high gets broken.

If the swing high doesn’t get broken then those setups are not valid.

Sunday, July 21st

This trade was just completed so apologies for not being able to get it posted in time for it to be a live trade. We got home after 5 pm this Sunday and I saw the trade was in “free trade” territory. What that means is the final exit will not be any lower than the current entry.

You can see from the chart the arrows of the bars I got in and exited on. This was the 123-161 trade setup. The price had gone all the way down to the 200% Fibonacci extension level and the other exits had not been hit. I remember seeing this at the end of trading on Friday and thought about getting in then but I didn’t feel like holding it until Sunday. Also, I was kind of looking for a move a little lower.

Obviously, the move lower did not happen.

When the price hit the 200% extension level (the blue line) then the exit moves to the top of the white box which is around 7,850. That is where my exit was set when I got into the trade. It was a quick trade because I use the 15-minute charts to day trade from and it was completed in 3 total bars from conception to completion.