The stock market over the past two weeks has been pretty crazy. From hitting the highs to huge plunges there have been historical daily swings. Since Trump’s election the stock market had gone pretty much straight up until now. We have the 1st pullback and I don’t think it is over. It may take a break for a bit from the huge moves but there is still more room to the downside. The S&P 500 isn’t done going lower. Let’s look at the charts.

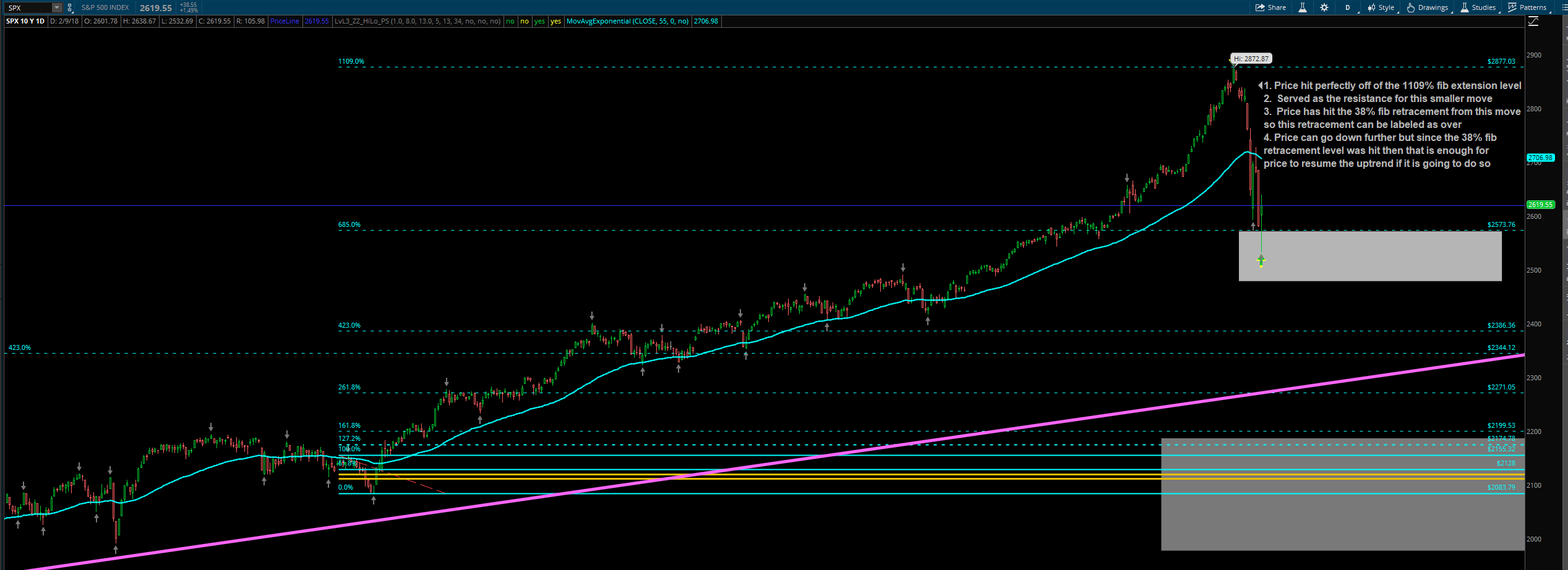

The First Move is Complete

Price hit perfectly off of the 1109% fib extension level and served as the resistance for this smaller move. The S&P 500 has hit the 38% fib retracement (top of the gray box) from this move so this retracement can be labeled as over. Price can go down further but since the 38% fib retracement level was hit then that is enough for price to resume the uptrend if it is going to do so. You can also see that the 38% Fib retracement served as a support level so far. But this is just a smaller move within a bigger one. Let’s look at the bigger move so we can see that price could still move down much more.

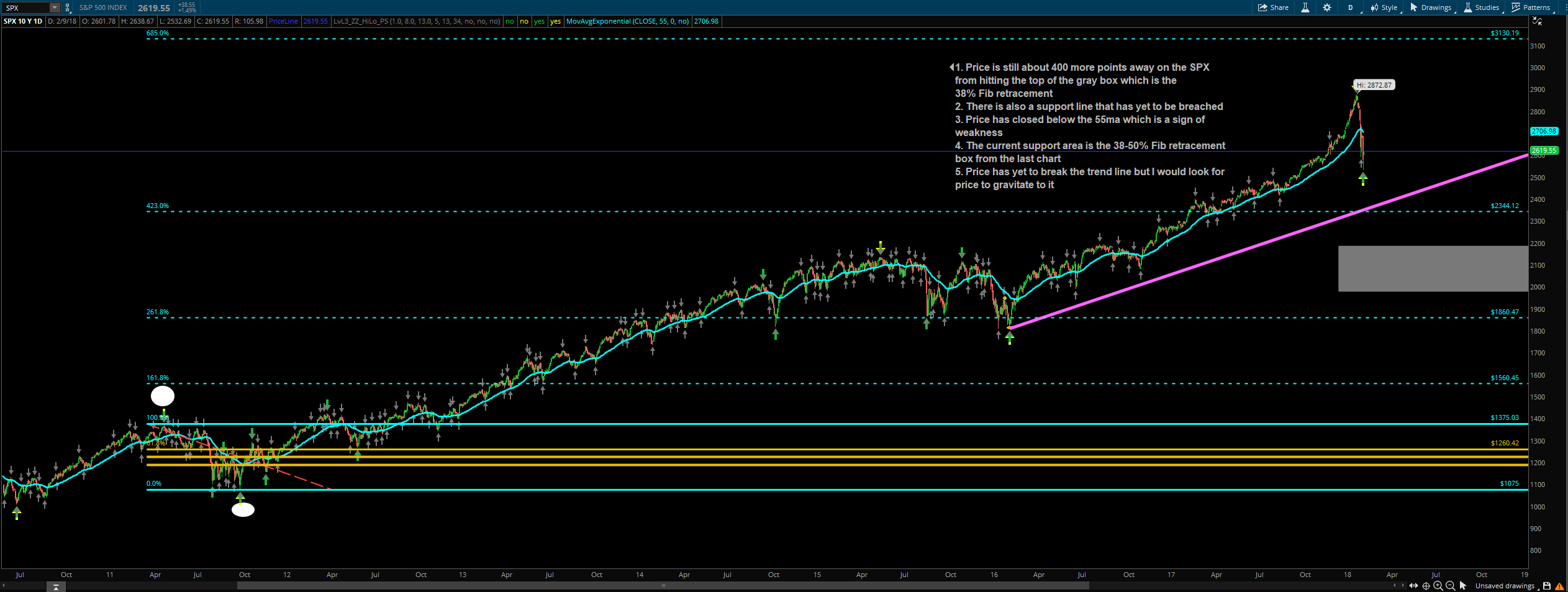

The Second Move Might Be Setting Up

Price is still about 400 more points away on the SPX from hitting the top of the gray box which is the 38% Fib retracement. There is also a support line that has yet to be breached. Price has closed below the 55ma which is a sign of weakness. The current support area is the 38-50% Fib retracement box from the last chart. Price has yet to break the trend line but I would look for price to gravitate to it.

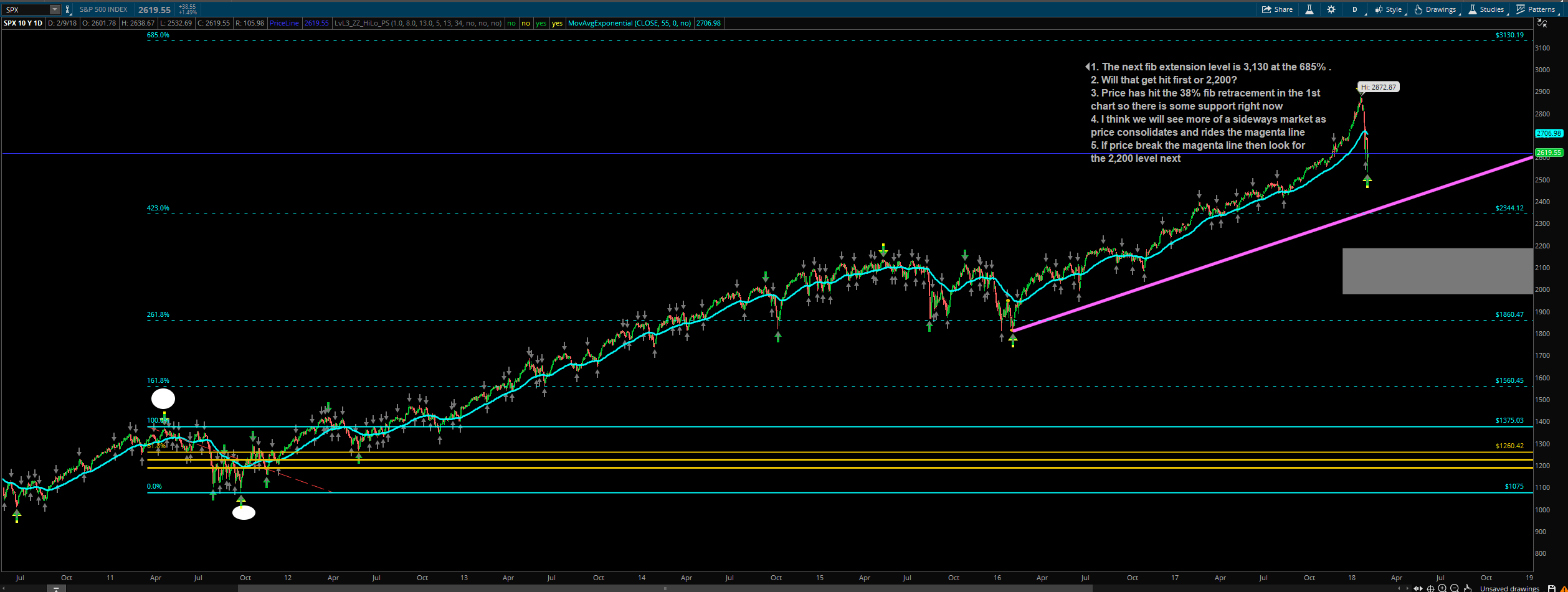

What’s next: 3,130 or 2,200?

The next fib extension level is 3,130 at the 685% level. Will that get hit first or 2,200? Price has hit the 38% fib retracement in the 1st

chart so there is some support right now. I think we will see more of a sideways market as price consolidates and rides the magenta line

If price break the magenta line then look for the 2,200 level next.

Conclusion

I think we see some consolidation before the next move either way. I hate hedging so here is my call: The SPX (S&P 500) consolidates for a bit more lower and then goes and hits around 3,130 before the retracement happens. I think we hit 3,100 before we hit 2,220. Then once price goes past the previous high of 2,872 the 38% Fib retracement level will rise as well so that 2,200 current target would move up.