As my evolution in my trade setups continue I believe I had a break through today. For awhile now I had been stumped on the correct exit for my Fibonacci extension short trades. Most of the time the retracement back to the 50% fib was money but there was the rare occasion where price would get close to it but not close enough for me to consider the 50% fib retracment hit and price would sky rocket up. Eventually price will come back and hit the 50% but why wait and tie up a lot more money when you can get out with a profit and the 38% and use the money on easier and faster acting trades. You will have seen on my posts about Bitcoin and Amazon how the exact scenario played out where price would retrace to the 38% but not touch the 50%.

Here are a couple of those posts:

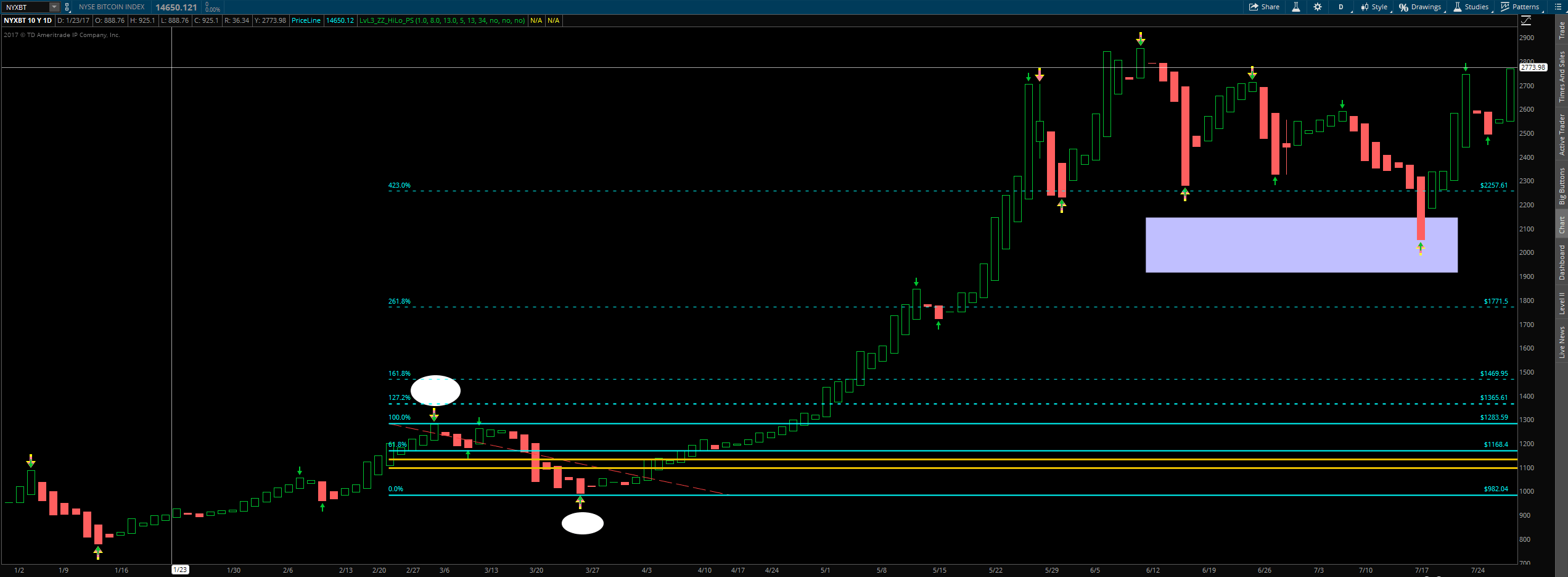

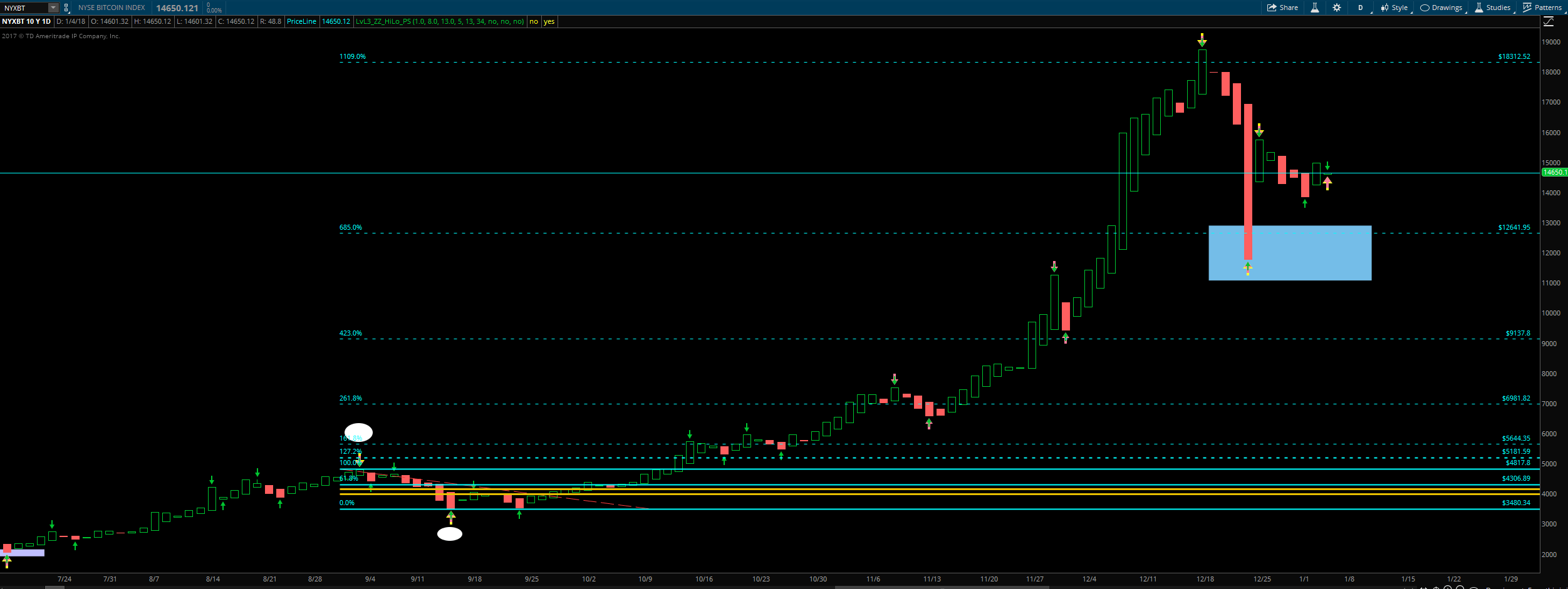

Bitcoin

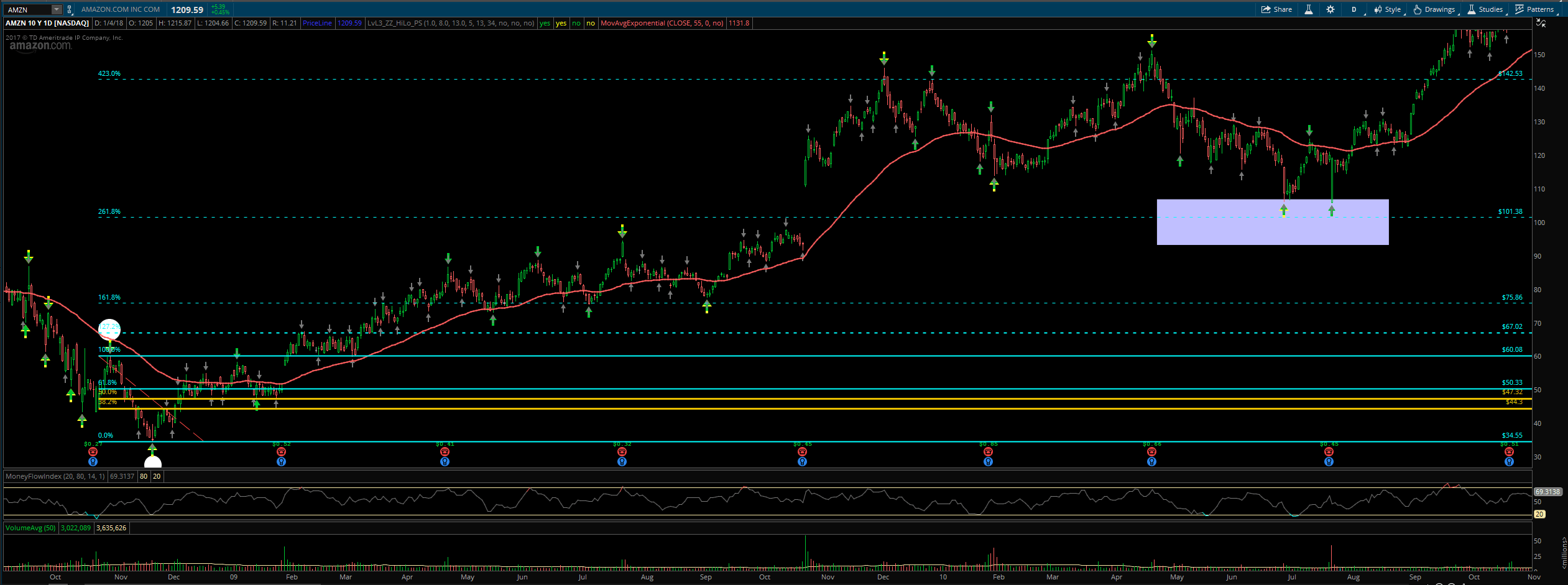

Amazon

In those posts I was looking for the 50% retracement to come back and get hit before I considered that specific retracement to be over. Today it came to me that I need to get out earlier for my shorts and that is when I thought about checking the 38% fib retracement level. The two charts that had stumped me and thrown a wrench in my bread and butter fib extension trade (write-up coming soon about it) were Bitcoin and Amazon.

38% Fibonacci Retracement Is Now the Exit

Now look at these charts below, the lavender box is the 38-50% fib retracement area with the top of the box being the 38% level. Before when I analyzed the charts of Bitcoin and Amazon the move is over at a normal level and not in astronomical fib extension levels like I thought it was when I was using the 50% fib retracement area as my exit point for the move. Now the move is over and price has hit the 38% level!

So as you can see my exit now for short trades using the fib extension bread and butter trade is the 38% fib retracement level. For my long trades I am still using the 50% fib retracement level, that has remain unchanged.