Are you thinking about buying McDonald’s MCD stock? I will go over precise entries and exits to look for no matter if the stock goes up or down.

2019 has been a really good year for McDonald’s and their stock price. With a low to around $170 and a high of around $222 the current price is around $200 at the time of this writing (October 22, 2019). I will cover the daily time-frame and hourly. I may even look at the 15-minute time-frame but I usually don’t go that low for stocks.

The hourly time-frame is the one I prefer. The daily is the time-frame I look for when looking at stocks with dividends to trade because these trades can take years to complete so it is more of a longer term investment then a trade. We’ll also look at the weekly time-frame so we can see the overall trend and historical movement for the MCD stock.

I personally don’t day trade stocks. They don’t have enough leverage to make it worth it to me. Maybe someday but not right now.

So that is why I trade using the 1-hour and daily charts when trading stocks. Recently I have been using the 1-hour chart because the daily charts can take years for the setups to complete.

With that out of the way, McDonald’s is the largest fast food chain in the world. Pretty much if you have been to any major city in the world then you have seen a McDonald’s restaurant. I’ve heard that they are secretly a real estate company rather than a fast food chain because they own so many properties. This theory makes sense and is very interesting but their bread and butter is selling fast food.

Where I grew up (Houston) we had wood chips for the flooring and splintered wood playgrounds. Now, pretty much all of the playgrounds are indoors to escape the climate and are much safer than they were before (where’s the fun in that?). In the picture above it was somewhat like that except there was wood chips for the flooring.

Growing up, eating at McDonald’s was a treat. Getting a Happy Meal was awesome. Now it is more of a punishment to me when I have to eat there, unless it is breakfast. Their McGriddle is awesome. I’ll talk more about McDonald’s below in the “news” section because I want to dive right into the chart analysis.

Technical Analysis for McDonald’s Stock

The setups I will use for the analysis will be primarily the 78.6% and the 823.6% trade setups. There is also the Springboard Setup but the 78.6% and 823.6% setups are the ones I have been primarily using for the past several months which have been working very well for me.

I use these setups for stocks, Forex, futures, and cryptos.

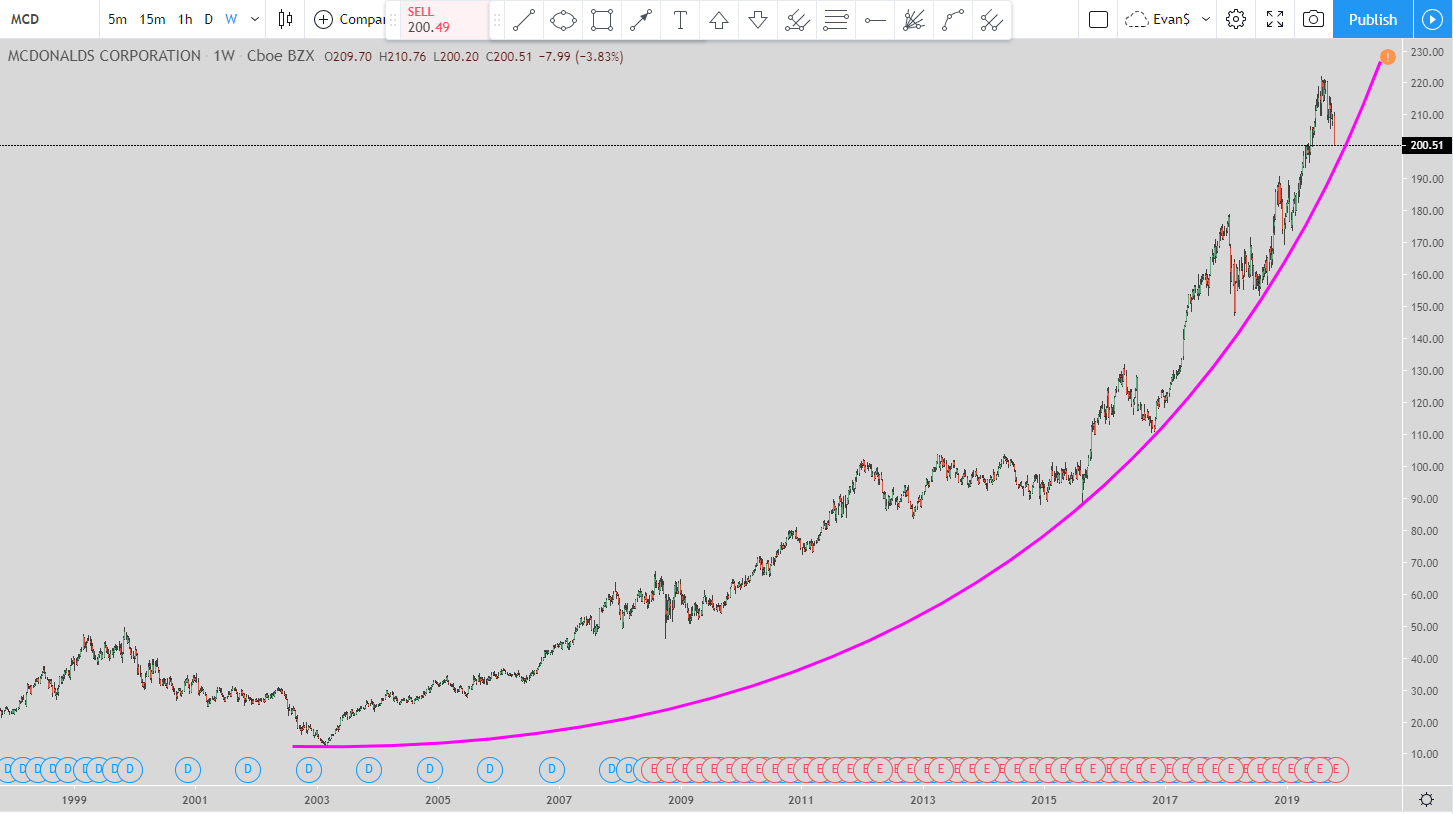

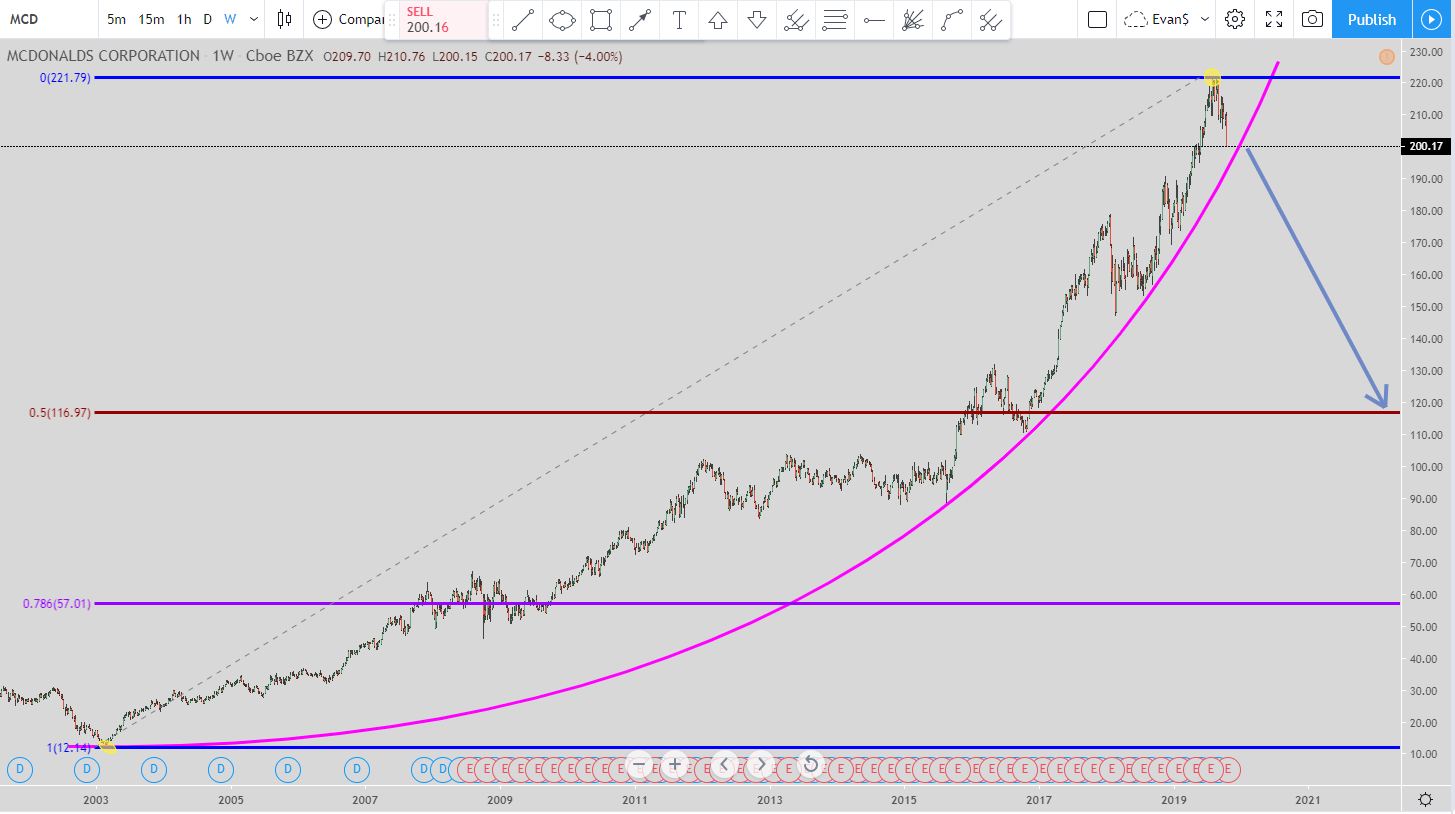

We’ll also use the Parabolic Curve which I do use for long-term trends and trend lines to see when I think the trend may break and the retracement may start.

In the weekly chart of MCD above, you can see the massive uptrend McDonald’s has been on since around 2003. Even in the financial collapse of 2009 they were not hit nearly as hard as most other companies.

The pink line is the Parabolic Curve. Please be aware that the drawing of a Parabolic Curve is subjective but what I try to do is get as many points of the price touching it as possible. I think I have done that in that drawing.

If the current high of $221.93 holds then the Fibonacci retracement levels will remain intact. But if the price goes above it without the 50% being hit that I will talk about in a second then the levels will change that won’t be covered in this post.

When the Parabolic Curve breaks then I will be looking for the 50% Fibonacci retracement level to be the 1st level to look for with the retracement. That price is around $117. That is the level I am looking for the break in the Parabolic Curve retracement to complete. It can also go down to the 78.6% level which is around $57 but that one isn’t guaranteed.

So when the Parabolic Curve breaks look for the retracement to go down to $117.

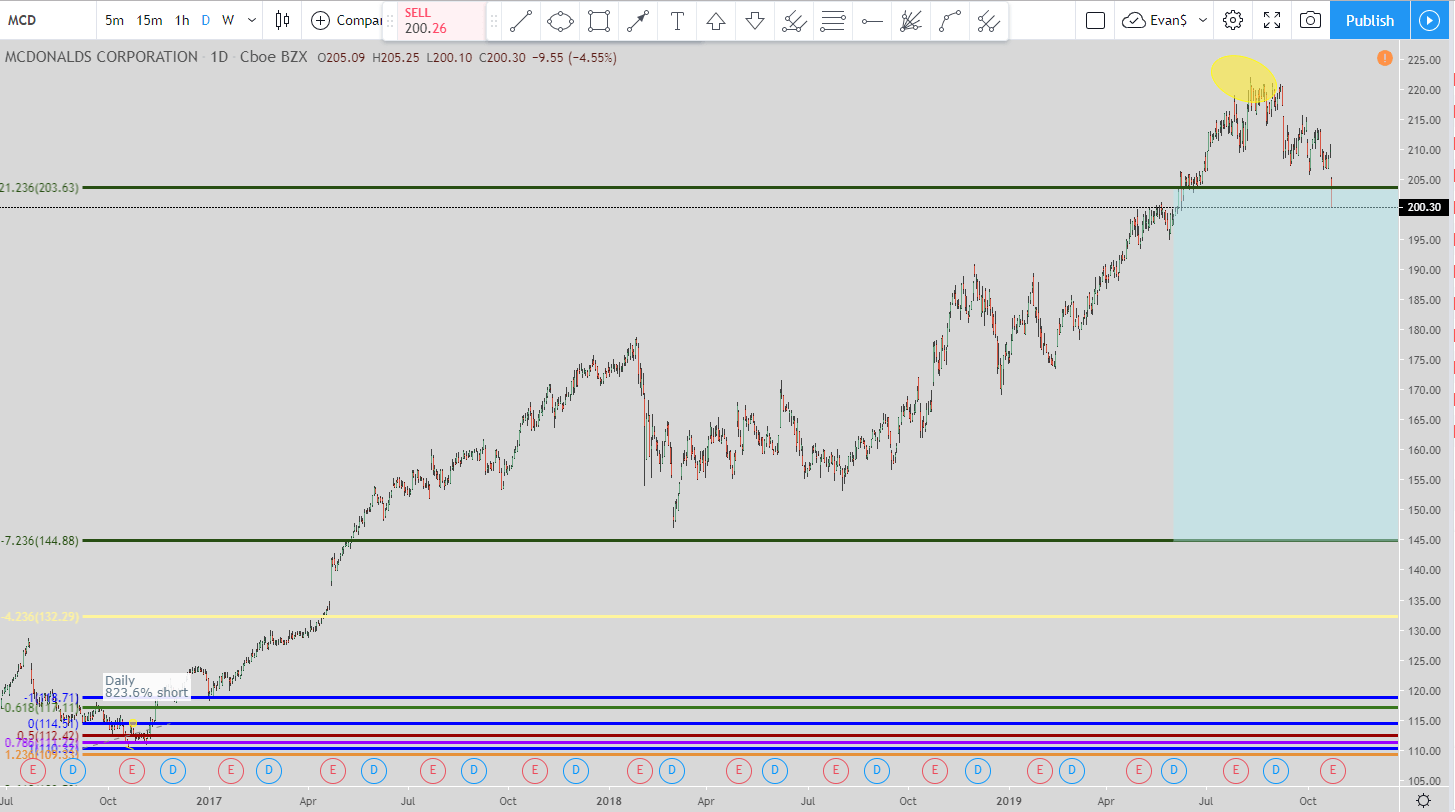

Daily Stock Chart

In the daily time-frame we have the 823.6% trade setup. This one is a short setup. The 1st entry would have been when the price hit the -7.236% Fibonacci level which is really the 823.6% Fibonacci extension level. When you go the opposite direction when drawing the Fibonacci points you have to add 100% to the negative numbers to get the correct level as if you were going the positive direction.

Once that was hit then then exit would have been at the yellow line around $132.30. But since that wasn’t hit and the price went up and hit the -21.236% level at $203.63 then this moved the exit to just above the -7.236% level around $146.

I always have my exits slightly off of the exact exit level to ensure my exit gets the filled. The true exit is $144.88 but I’ve seen the price plenty of times go down and tick the exit but there would not have been enough contracts traded in order to get you out of the trade. So that is why my exits are always slightly before the hard exit.

From this exit level around $146 this exit will not move again. Even if the price continues to move higher this exit level will not move again. So if you are looking at shorting McDonald’s stock then this is an excellent price to do so at.

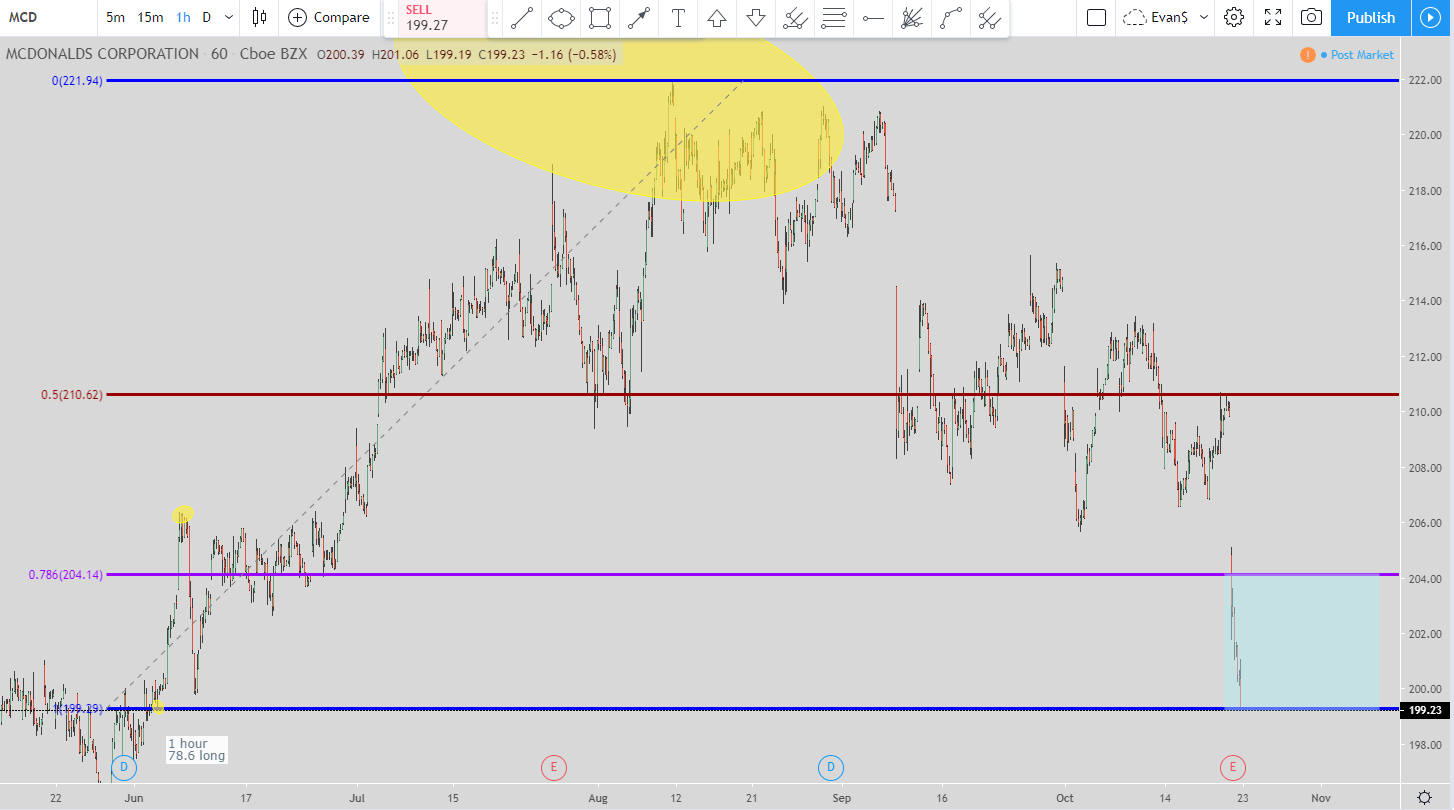

1-Hour Stock Chart

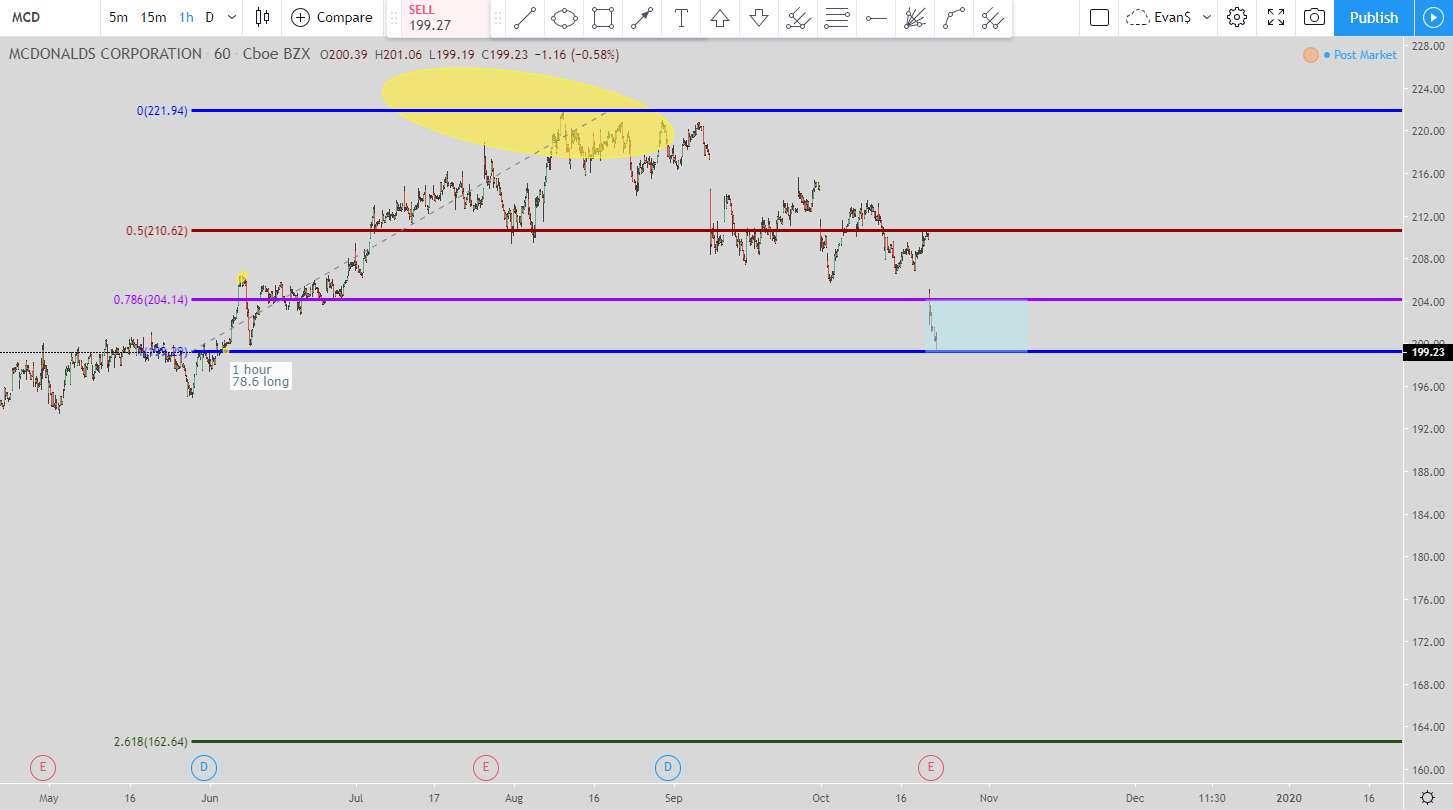

In the 1-hour time frame we have a long setup using the 78.6% trade setup.

The 1st entry was when the price hit the 78.6% level but as you can see it powered through there and now hit the 100% Fibonacci level at $199.29. So when that happened the exit moved from the 50% level to the 78.6% level which makes the hard exit at $204.14.

In this next picture of the 78.6% long trade there is one more possible entry and exit move. If the price of the MCD stock goes all the way down to the 261.8% Fibonacci extension level at $162.64 then the exit would move to the 100% level at $199.29.

But that only happens if the 78.6% exit is not hit first. If that exit is hit then the move is over and you do not look to get in at the 261.8% level. But if the price does not hit the 78.6% exit and goes down and hits the 261.8% level then you would enter there and move your exit to the 100% level.

That would be the last time you would move the exit. Even if the price continues to move lower you do not have to move the exit again.

Video for the MCD stock

Recent News for McDonald’s Stock

Recently the price of the MCD stock has taken a bit of a hit. The main reason is because McDonald’s missed on earnings as U.S. sales figures fall short.

McDonald’s was “noticeably missing” from that fight, Stephens analyst Will Slabaugh said in a research note on Monday. The sandwich frenzy may have plucked some customers away from McDonald’s, he said.

“Looking to 2020, we expect MCD to work through supply chain issues and offer a higher quality chicken sandwich that better rivals Chic-Fil-A, Popeye’s, and (Wendy’s),” Slabaugh said in a research note.

But the even bigger news from the article is that McDonald’s purchased a company named Dyanamic Yield which focuses on artificial intelligence.

That acquisition deal, announced in March, was intended to help McDonald’s offer more efficient and personalized service at the drive-thru. Dynamic Yield’s technology can recommend items based on past purchases and suggest items that are easier to prepare during busier hours.

McDonald’s, in July, said it would install the technology in more than 8,000 U.S. drive-thrus into August.

That is very intriguing as McDonald’s looks to digitize their fast-food service.

Even though McDonald’s reported less than stellar earnings, I agree with Jim Cramer that this can present a great buying opportunity.

I think McDonald’s is a buy. But there’s a problem here. Almost every single firm that follows McDonald’s has a buy on it. That’s an accident waiting to happen. If any of these other analysts do similar checks on the company with a stock up 17% there’s a likelihood that you catch a downgrade and a further cascade.

Mind you, I expect a lot of defenses given the hammering but it’s truly a tempting situation for any analyst who’s been riding the stock higher ever since whiz Steve Easterbrook became CEO. I would be more worried about trying to sell it and then buy it back when the shake-out is over. Plus, we can’t even be sure that the channel checks they are doing are even right. I can’t tell you how many times I have seen these kinds of projections be inaccurate.

To me the choice is clear: go with Chipotle, which we know is doing well, but if you own McDonald’s I think you can ride this weakness out as ultimately if there is something wrong I am confident that Steve Easterbrook will figure it out and fix it. Yes, he is that good, and that’s what matters.

Although, based upon my setups I would only begin nibbling at the stock. If the daily short that I went over takes place and the 1-hour long setup doesn’t get filled for the exit but retraces back to the 261.8% level then you could have an excellent buying opportunity on your hands.

That is how I would play the stock and to be honest I am looking at getting long with McDonald’s. I’m not going to do so in the next couple of days unless the stock continues to go down extremely quickly. I’ll be looking at the 78.6% long trade and hoping that the price goes all the way down to at least the 261.8% level before I think about getting long with the MCD stock.

Conclusion

These entries and exits I provided are based upon the setups I am personally using to trade the markets. Currently, I trade futures, Forex, stocks, and crypto-currencies using different time frames.

How I got to this point was through meditation. Before, I spent tens of thousands of dollars and spent thousands of hours studying the markets and how to trade them to be profitable. The only thing in common was that I wasted a lot of money and time in trying to learn from people who were not profitable traders. The only thing they are good at is selling their trading products/services, trading room subscriptions, and mentoring.

Just about every “guru” selling something in the trading world is a scammer. No one provides proof of their profitability even though it is extremely easy to do so. My rule of thumb is that if anyone is selling their trading service/product and won’t provide their proof of profitability then they are a scammer.

Here is the post where I show the steps I personally use with my meditation to discover new setups: https://evancarthey.com/how-to-become-a-profitable-trader-using-meditation/

It is 100% free. The only thing you could purchase is a book I recommend. Other than that there isn’t anything else. My goal in this website is to provide the information on my trading journey that hopefully helps you become a profitable trader.

It wasn’t until I started meditating to tap into my subconscious mind in order to trust myself and my trading setups which is when I first tasted my first prolonged profitability.

The goal is to trust yourself and your trading setups. That is why trying to copy somebody else’s trading setups is doomed for failure. You don’t trust someone else’s trading setups 100% so you won’t trade their setups optimally. Add in the fact that their setups probably aren’t profitable anyways and you have a guaranteed failure.

You can do it. If I can do it then you can do it. Plus, meditation will help you in just about every other area of your life so give it a try and see if it might be the key that was the missing link to your trading profitability.