For the S&P futures live technical analysis for the week of 9-15-2019 we have some breaking news that will impact the markets heavily this week. Earlier today Saudi Aramco had some of their refineries attacked by drones which knocked out over 5 million barrels of their daily crude output. That is around 50% of their oil output.

This is massive news for the upcoming week. In the long term, it won’t really impact the markets too much but this week will start off as a wild one. Oil has jumped over 11% in the pre-market so it will be interesting to see where they wind up when the dust settles. I think eventually they will come back to the mid 50’s which is where they were before this happened.

Also, President Trump says the US is ‘locked and loaded’ after the attack on the Saudi oil supply. The one thing markets hate is uncertainty and anytime there is a threat of an attack or any type of war than in the short term that is usually bad news for the bulls.

This post is focusing on the S&P 500 and not oil but it is very important to point out this massive news regarding the attack because this will impact the S&P 500 this week.

What the News is Saying About the Upcoming Week

There is also a strike going on with GM. It is the first time since the financial crises back around 2008. If you own the GM stock then this is something to watch but I don’t think it will impact the markets. At least not since the Saudi oil attacks.

The strike, depending on its length, could easily cost GM hundreds of millions of dollars.

The last time the union declared a strike at GM was in 2007. The two-day work stoppage was estimated to have cost the Detroit automaker more than $300 million a day.

The strike will take effect at 11:59 p.m. with roughly 48,000 workers heading to the picket lines.

Here are the highlights regarding the Saudi oil attack :

The drone strikes on facilities in Abqaiq and Khurais eliminated 5.7 million barrels of production over the weekend.

Officials believe that they can restore 2 million barrels by the end of the day Monday.

Experts said that the strikes could cause oil prices to rise up to $10 per barrel.

Saudi Aramco is aiming to restore by Monday about a third of its crude output that was disrupted after drone attacks on two key oil facilities, The Wall Street Journal reported Sunday, citing Saudi officials familiar with the matter.

The drone strikes on facilities in Abqaiq and Khurais eliminated 5.7 million barrels of production over the weekend. Officials believe that they can restore 2 million barrels by the end of the day Monday, contrary to earlier claims that full production would resume early this week.

Aramco, the national oil company, has determined that its facilities were hit by missiles, people familiar with the matter told The Wall Street Journal. A U.S. government assessment determined that up to 15 structures at Abqaiq were damaged.

S&P Futures Live Technical Analysis for the Week of 9-15-2019

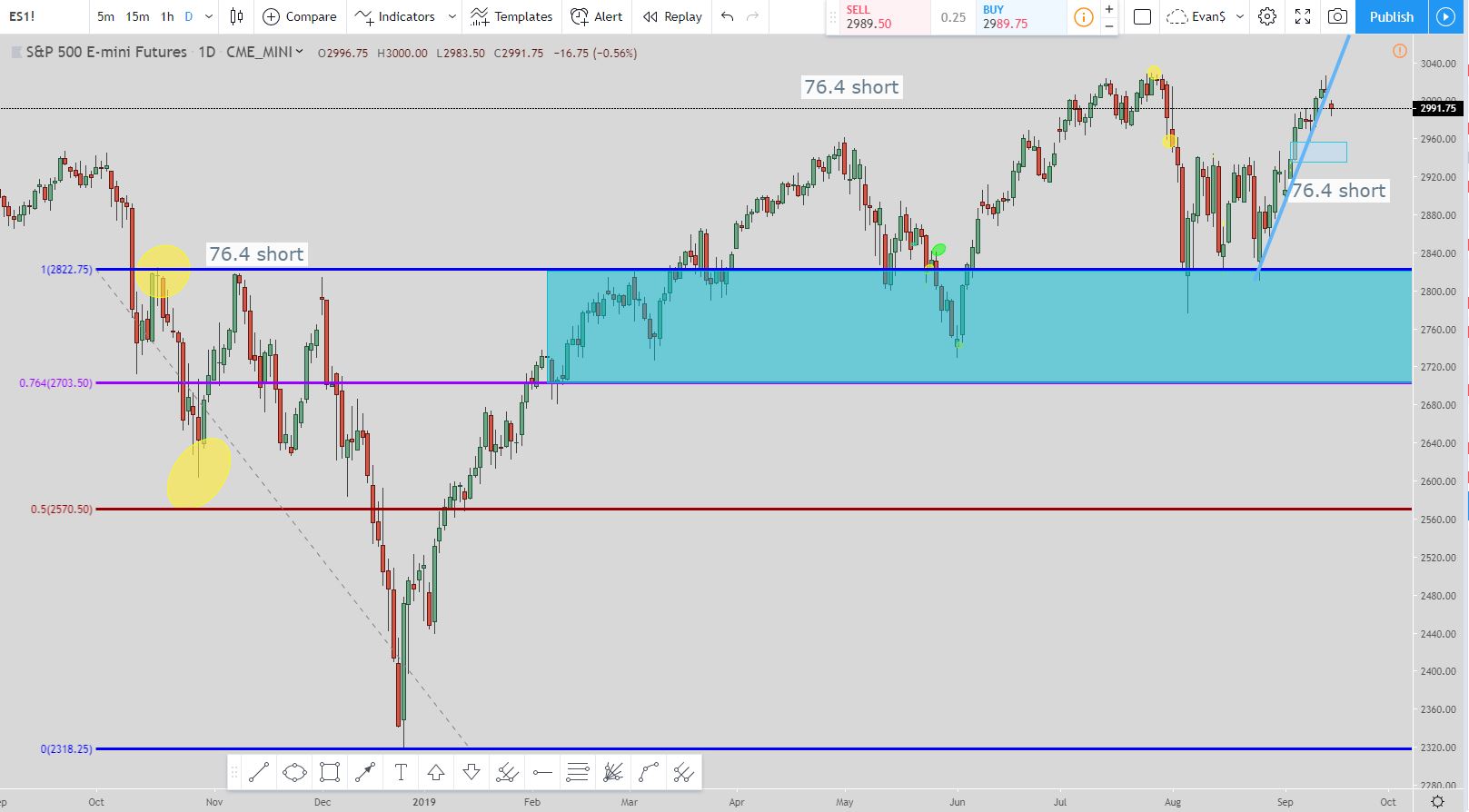

Here are the charts I am looking at for the S&P 500 futures that will be featured in the video as well.

Here is an 8.236% short trade using the 5 minute chart. The trend line has broken and the exit we are looking for is the bottom of the red box at around 2,875.

This is a 76.4% trade. The exit is the red line at around 2,902.50. You can see the trend line broke here as well.

This is another 76.4% short. But this time we are using the daily chart. The exit is the bottom of the teal box around 2703.50. I didn’t put it on here but the trend line had already been broken and was hitting off the other side. So support has turned into resistance.

In this last chart, it is using the 15 minute time frame. Again, the trend line has been broken and the exit we are looking for is the bottom of the blue box at 2,935. Please note the gap above so my prediction is price goes back up to fill the gap and uses the trend line as resistance now.

Video for the S&P Futures Live Technical Analysis for the Week of 9-15-2019

If the video does not load below then click on this sentence to be taken to it.

Conclusion

It is going to be a wild ride to start out the week. As mentioned above anytime there is an attack of any kind that impacts the global economy then the markets will go down. The markets hate uncertainty and being attacked is the biggest uncertainty.

Plus we have President Trump waiting for confirmation before the US retaliates. So add that to the mix and this could be a story that does last all week. At least as far as the attacks are concerned.

For the US markets long term, I don’t see it impacting it too much. There will be some selling but we will eventually recover.

But at least this week if you are looking for excitement in the market then you have got it. Monday should be a crazy day to start the week.

Also, if you are looking for a broker to trade stocks that don’t charge trading fees then check out Robinhood: http://invite.robinhood.com/evanc203.

If you register using the link then both of us will receive a free stock.

As always, continue to check out https://evancarthey.com for the best news and reviews for ways to make money trading.