November

11-29-2019

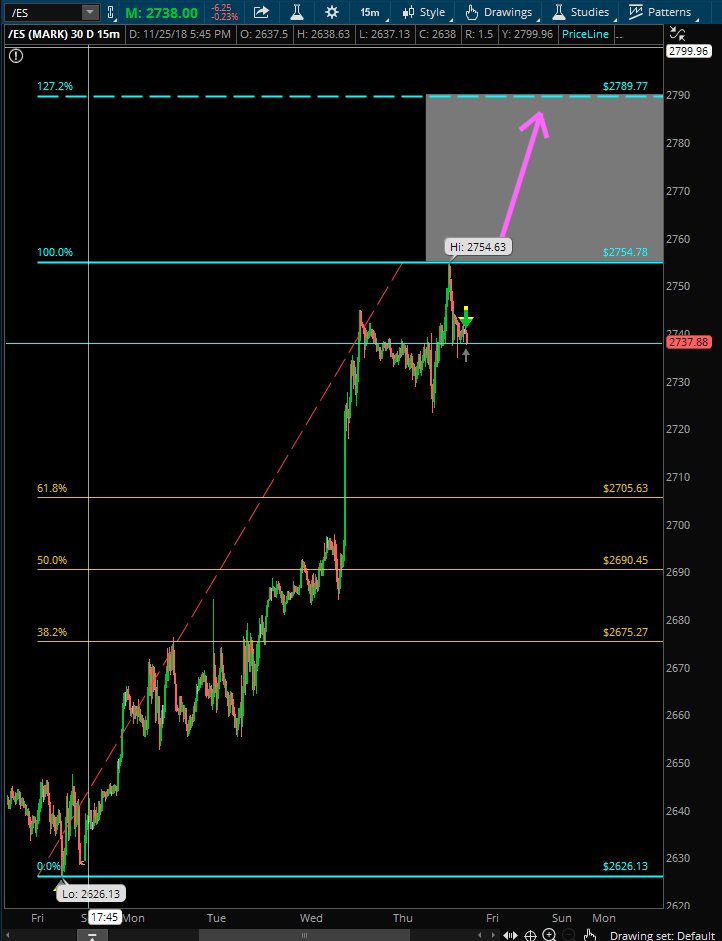

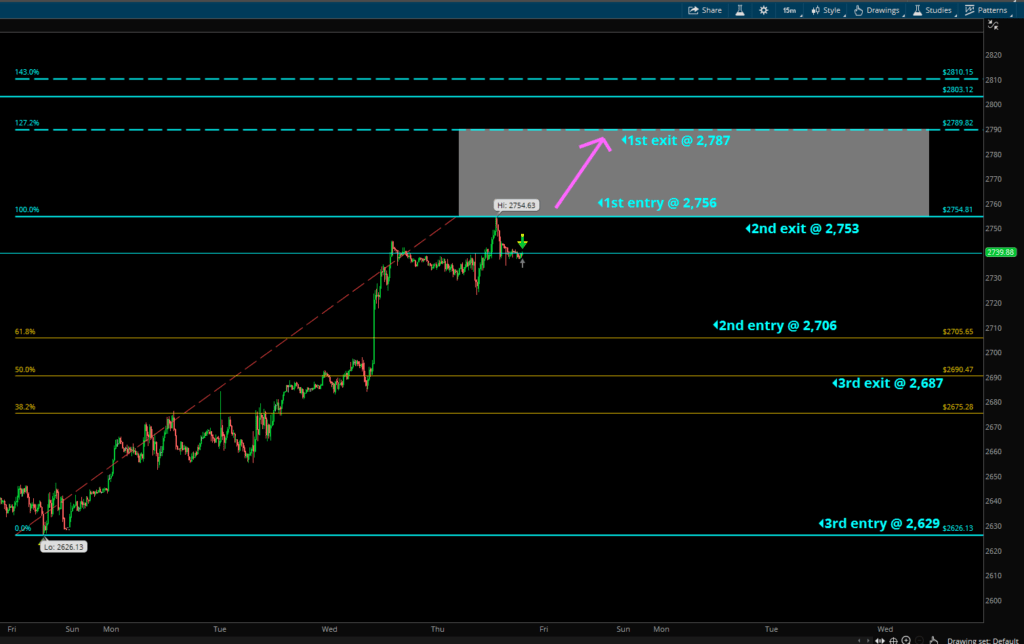

The S&P 500 minis (ES) is shaping up to possibly be a great buying opportunity. If price goes to 2,756 then that is the signal to go long. So when price hits 2,756 then go long and you are looking for an exit of 2,787. The hard exit for the trade to be complete is 2,789.75 but as you have seen from my recommendations……. I always recommend to get out a little early to ensure the exits get filled.

So to recap, if price goes into the grey box at 2,756 then that is your signal to go long. The exit is at 2,787. Now here is where it becomes a Lightning Trade but only if price has NOT hit 2,787. If price has then the rest of this below is invalid become the move is over.

For the 2nd entry and exit if price goes down and hits 2,706 then you enter with the same number of contracts you got in with if you went long at 2,756. But this is ONLY if price has not hit 2,787. You then move all exits to 2,753. If price fulfills the exit then the move is over and the next part is invalid.

Now if price doesn’t go back up and hit 2,753 then you enter at 2,629 with 3X the amount of contracts used for the first entry at 2,756 (the grey box). You then move all exits to 2,687. From this point (your 3rd exit) does not move @ 2,687. Even if price continues to move down you hold that exit. You can get in for more contracts if price continues to go lower but that is the final exit point.

11-28-2018

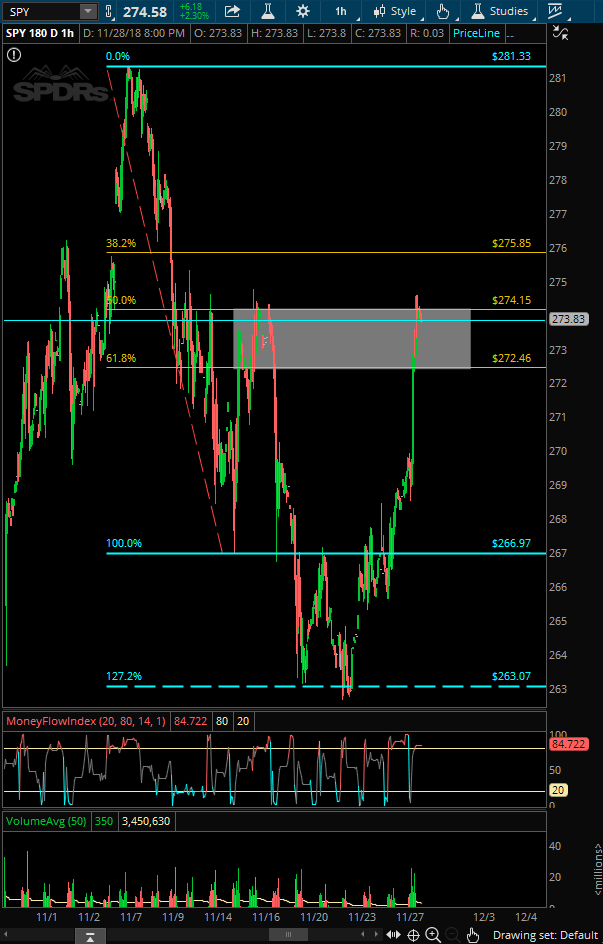

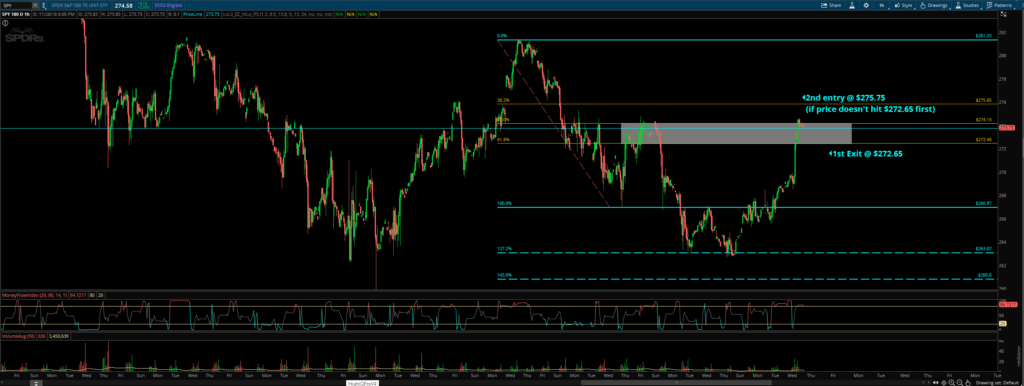

The SPDRs (SPY) has setup for a quick hitter trade. Price is currently at $273.83. If you go short now your exit will be $272.65. If price does go down and hit it first then this setup is over.

But if price goes up and hits $275.85 before hitting $272.46 then you will move your exit to $274.25 and you will also go short just under $275.85 at around $275.70. I would advise to have a limit order waiting to get filled.

This is my 38-50-61 trade setup.

So to recap:

You can go short now at $273.83. If you do then your exit is at $272.65.

If price goes down and hits $272.65 then the setup is over, time for a new trade.

But if price goes up and hits $275.85 then you’ll need to go short there, I would advise having a limit sell order just south of there at $275.70 to ensure you get filled.

Then you’ll move all exits to $274.25 and it does not move. Even if price continues to go higher your exit does not move. Feel free to get in if price does go higher without retracing to those levels.

11-23-2018

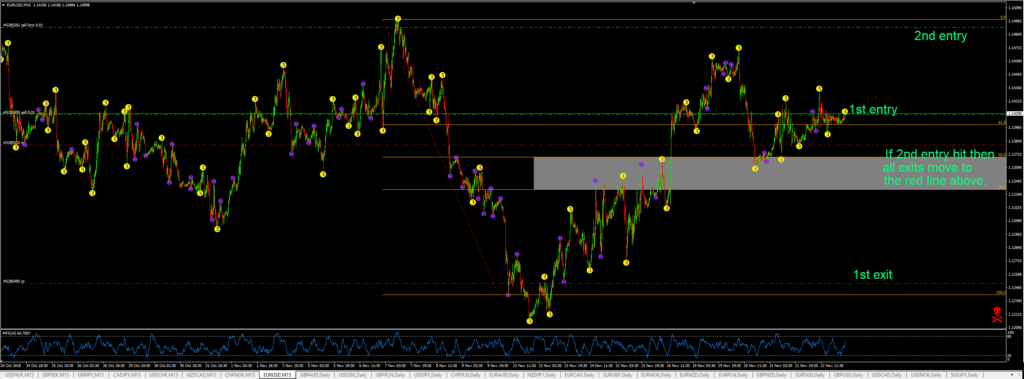

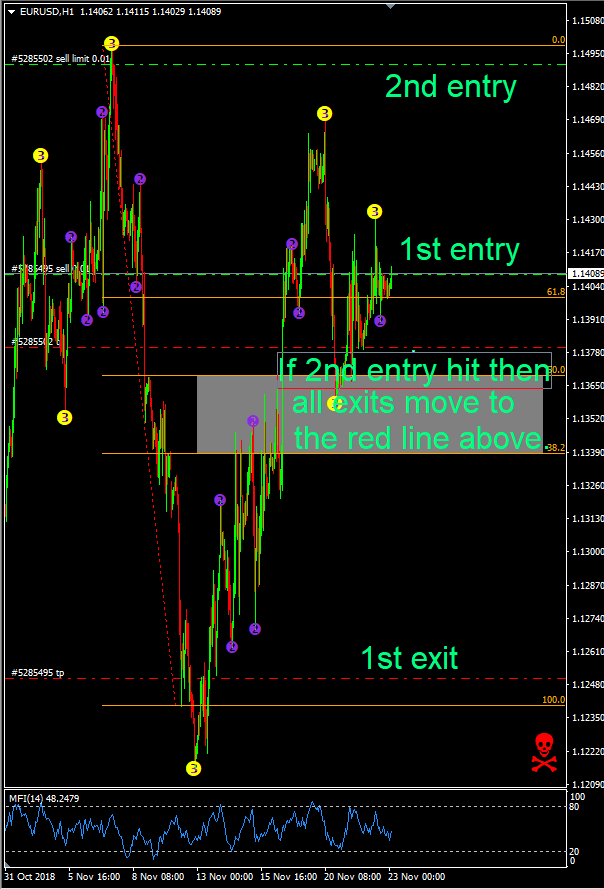

The EUR/USD is a trade I went live with today. It’s given enough a move without a decent retracement to key Fibonacci areas that it is a “free trade.” The rollover rate is also positive on the short side so another bonus.

I am currently short at 1.14085 and my exit is at 1.12504 (the lowest red dotted line). But the trade doesn’t end there. There is one more part to it.

If price goes up and hits 1.14979 then I have a limit sell order just south of there at 1.14907. If price does go up and hit 1.14979 then we move all exits to 1.13800 and they do not move from that point no matter what price does. That is the red dotted line just above the grey box.

Now, if price moves down from my initial entry and hits 1.12504 then I will remove the limit sell order at 1.14907 because the move is complete. This is my Lightning Trade.

11-22-2018

Even though the US markets are on holiday for Thanksgiving it doesn’t mean the Forex market is closed.

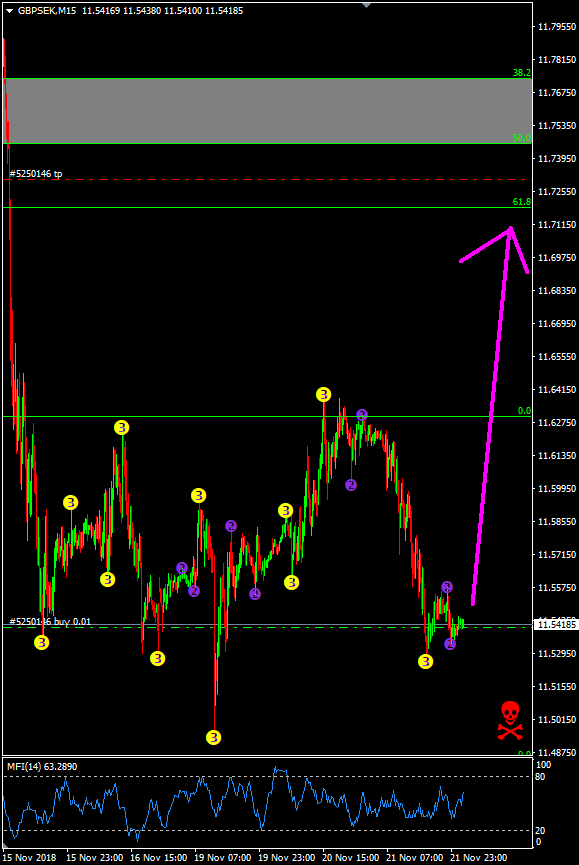

The GBP/SEK is looking real good for a long. In fact I took this trade today. Right now as I type this price is at 11.54185.

As you can see from the picture below the red dotted line is my exit which is at 11.73051. Even if price moves against me my exit will remain the same at that spot. This is what I call a “free trade” because price has made such a strong move down without a retracement to complete the move. So because of that it has given me a great opportunity to go long. On top of that the rollover rate is positive for longs so even if this does last a couple days or weeks I’ll get a little deposit from it into my account. Not a lot but something is better than nothing.

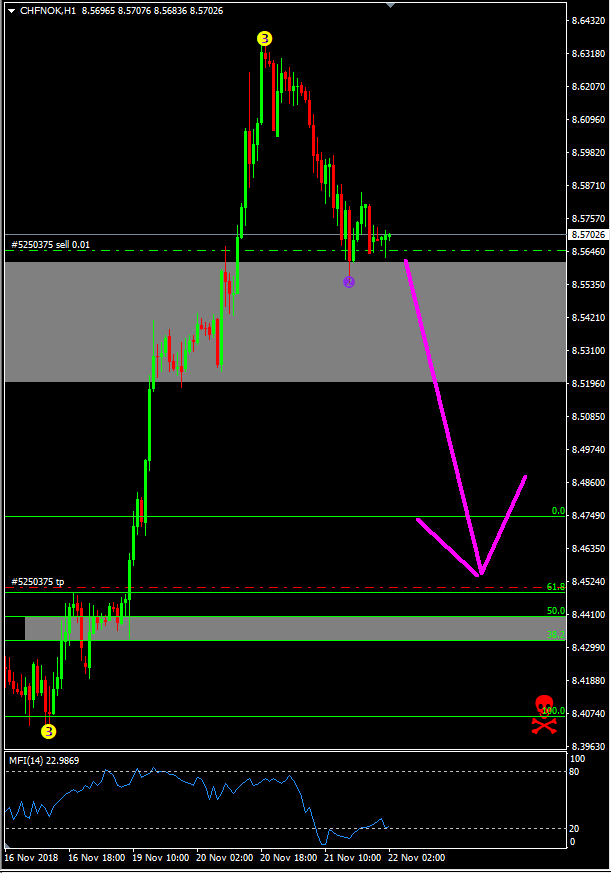

The CHF/NOK has given us a great opportunity to go short. I took this trade today as well and am currently in it just like the GBP/SEK. The short rollover rate is positive so again it will give us a little extra return if the trade stays open for a couple days or even weeks.

At the time of writing this price is at 8.56675. The exit I have is at 8.45029 and it will not move even if price goes against me. It will stay in that spot. Price has moved so far up without a retracement to complete the move that this has given me another great setup for a short.

Both of these trades are using my Lightning Trade Setup which is my favorite setup out of the 4 I use.

11-21-2018

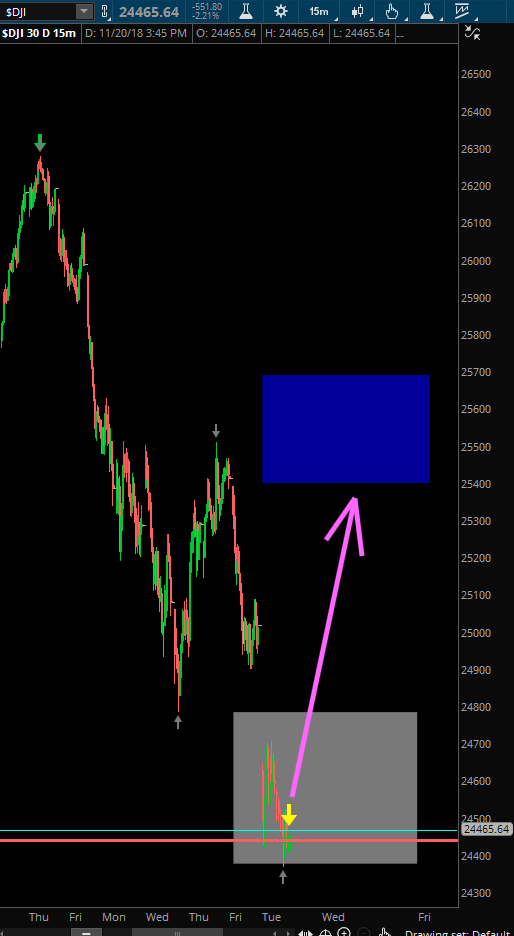

The Dow Jones (DJIA or $DJI) is prime for a pop-up. It reached the bottom of the grey box (127% Fibonacci extension level) and it completed a previous short move down where I put the red line to show you how perfect the completion was today. Between those two factors PLUS a gap above shows that a move to the immediate upside should happen in the next trading session or two. To complete the move up I would like price to hit the bottom of the blue box at 25,398. DJIA is currently at 24,465.

11-21-2018

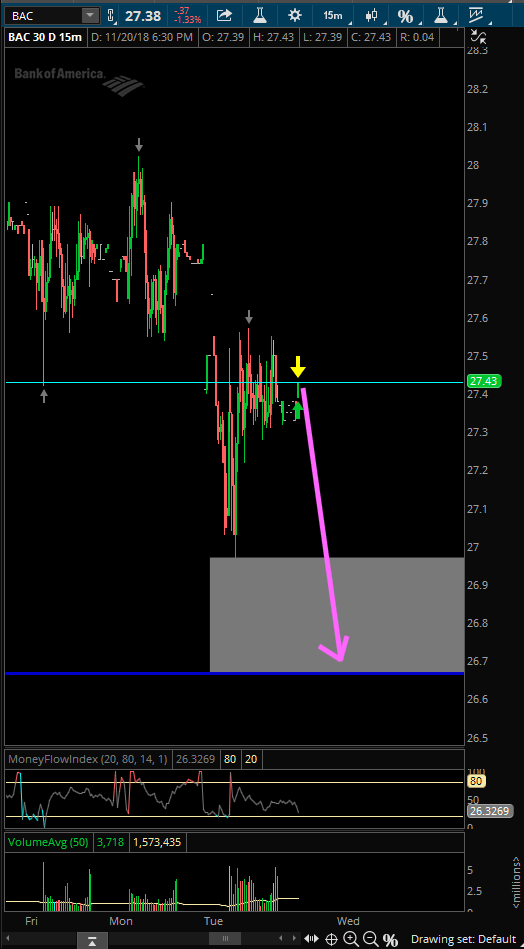

Bank of America (BAC) is in a prime position for a nice short. If you want to be aggressive then you can short it now at $27.43. The reason why is the 127% Fibonacci extension (the bottom of the grey box) lines up perfectly with the blue line. The blue line is a 50% retracement level from a couple of weeks ago that price needs to hit to complete a move.

Combined with those two items I think there is a good chance price goes lower. If you want to play it safe then enter when price enters into the grey box around $26.95 and have your exit at $26.7 for a quick scalp. There is a gap above so price could go up and fill that first but eventually price will go down to $26.70.

11-19-2018

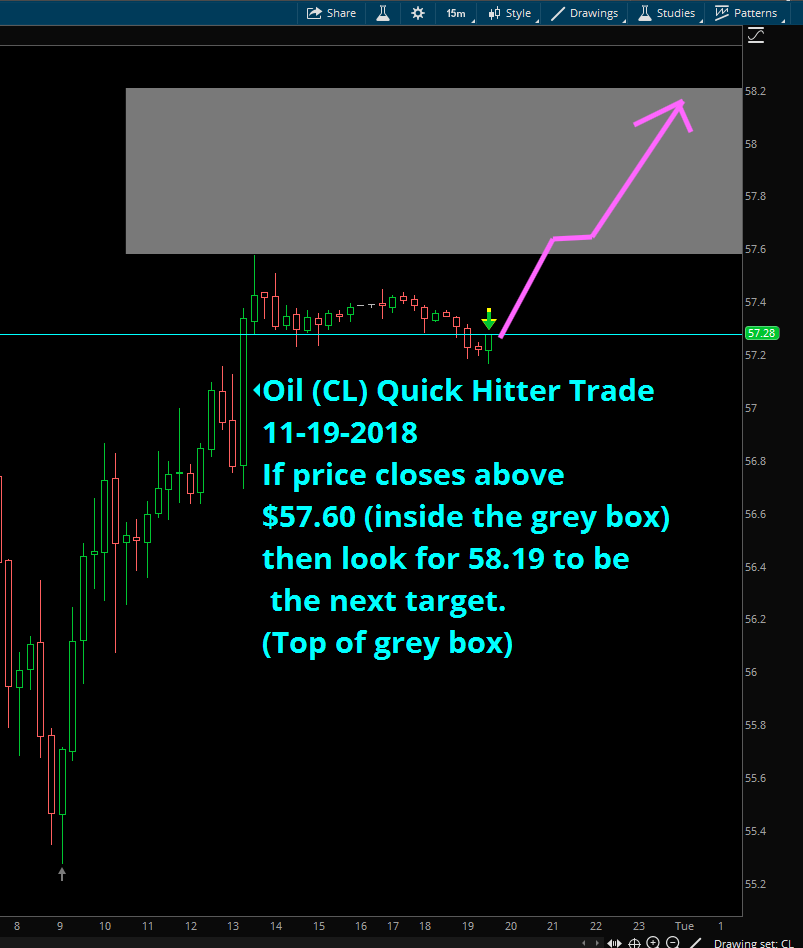

Oil (CL) has the potential to make a little run up over the next couple of days.

If Oil closes above $57.60 (inside the grey box) then look for $58.19 to be the next target. That is the top of the grey box.

15 min chart used.

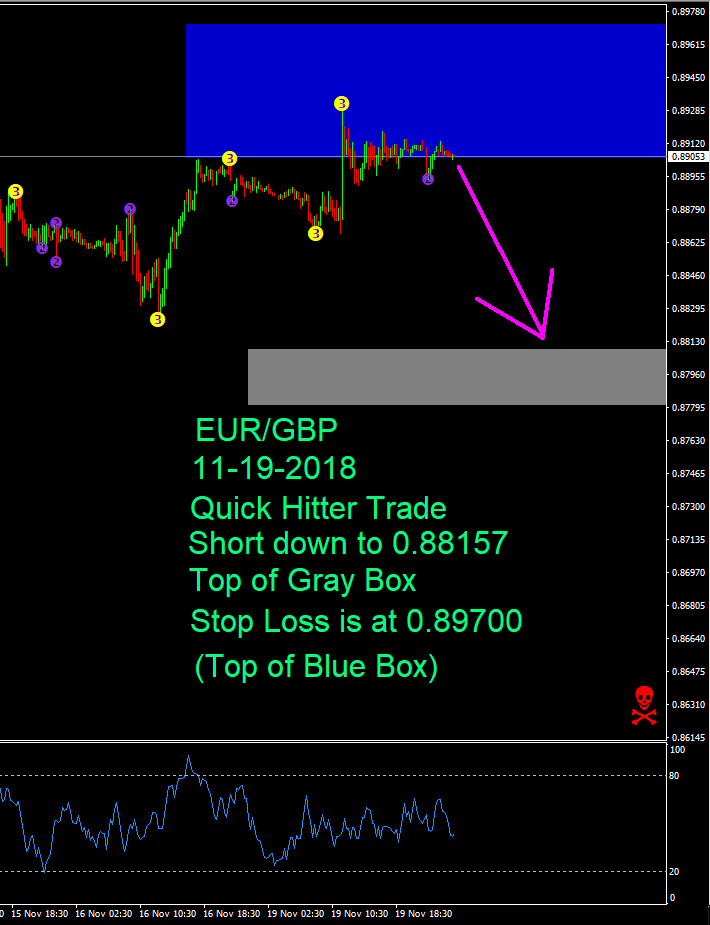

11-19-2018

The EUR/GBP is a good candidate for a short. Price is currently at 0.895053. You can short it down to the top of the grey box at 0.88157. That is your exit.

Your stop loss is at the top of the blue box which is 0.89700. If you want to go for the home run then your exit can be 0.86671. So if you do go that route then trade two units and have the first exit at 0.88157. Move the next to break even and let it ride down to 0.86671.

15 min chart used.

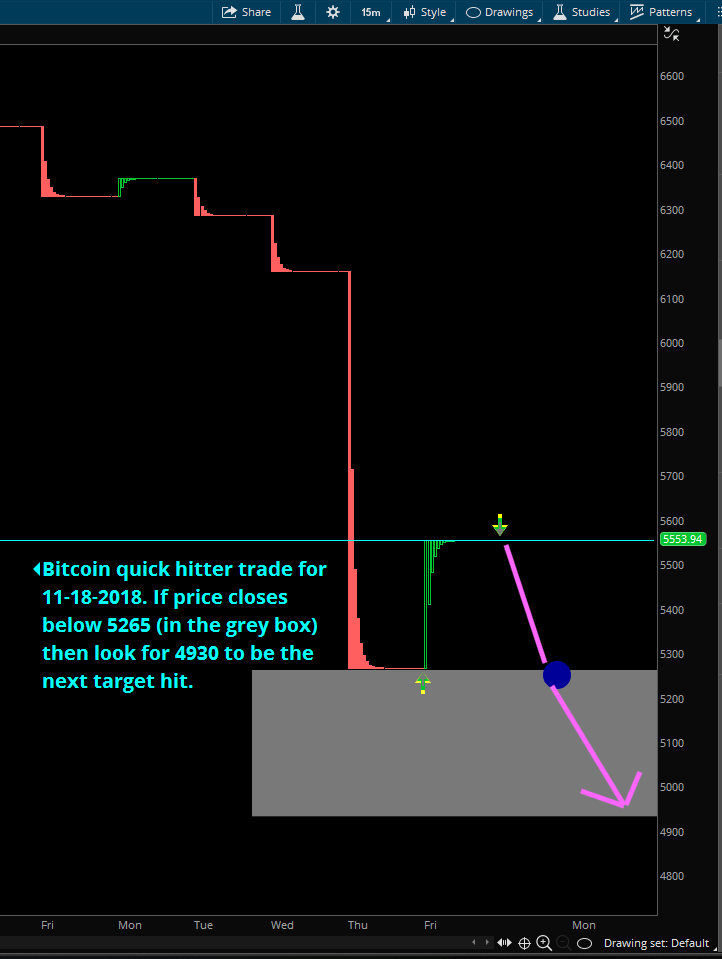

11-18-2018

Bitcoin has been going down the past couple of days in November and the next move looks to be another down move.

If price closes below 5,265 (in the grey box) then look for 4,930 to be the next target hit.

November/18/2018

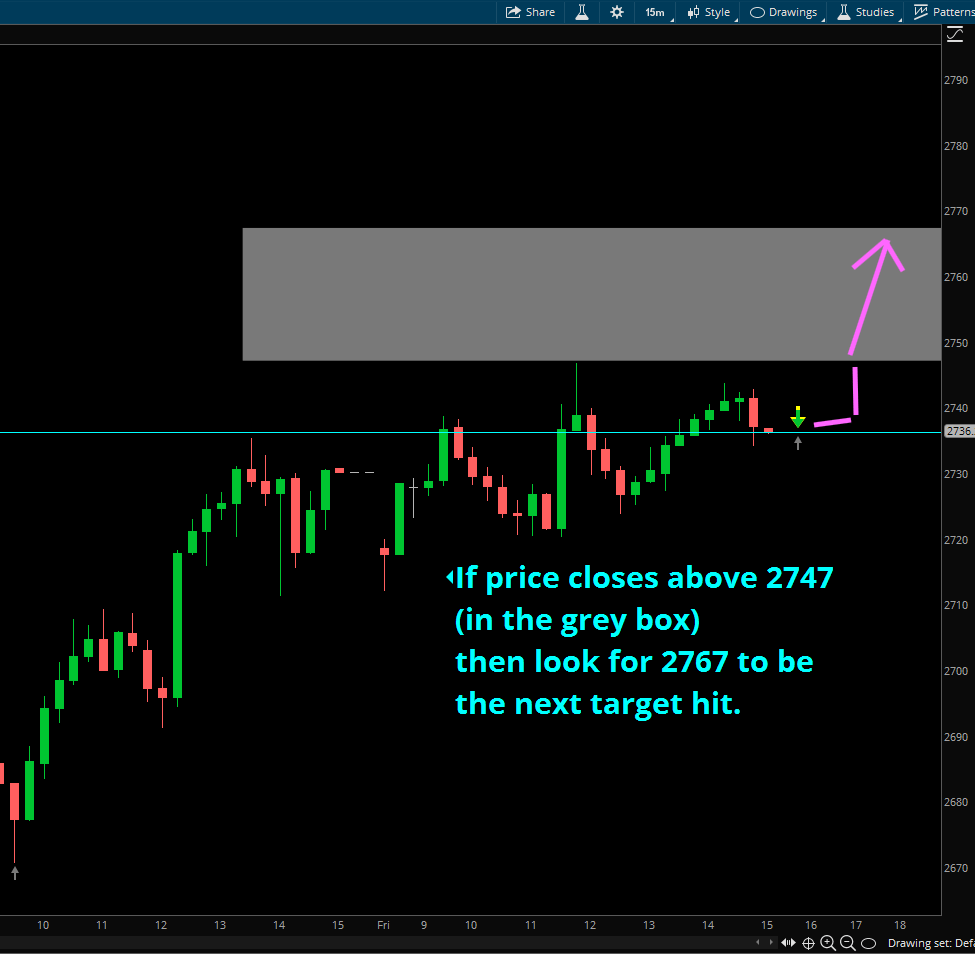

The S&P 500 (SPX or the ES) is prime for a quick hit for this trade on Thanksgiving week.

If price closes in the grey box which would be 2,747 then look for near the top of the grey box at the target of 2,767 to be the next target hit.